If you’re thinking about selling on Amazon, you may be wondering if you need a tax ID. The answer depends on a few factors, including the type of product you’re selling and the state where you’re located.

In general, if you’re selling physical goods, you will need to obtain a sales tax permit from your state. This permit will allow you to collect and remit sales tax on your transactions. Depending on the state, you may also need to register for a business license.

If you’re selling digital products, you may not need to obtain a sales tax permit, but you may still need to register for a business license.

When in doubt, it’s always best to consult with an accountant or tax professional to determine what licenses and permits you’ll need to sell on Amazon.

If you’re selling on Amazon, you may be wondering if you need a tax ID. In this article, we’ll break down what a tax ID is and whether or not you need one to sell on Amazon. We’ll also share some tips on how to get your business registered.

Whether you’re just starting out selling on Amazon, or you’re a seasoned pro, it’s always important to stay up-to-date on the latest rules and regulations.

In this blog post, we’ll answer the question: do I need a tax ID to sell on Amazon? We’ll also provide an overview of what your responsibilities are as an Amazon seller. So whether you’re just getting started, or you’re looking for some clarification on the tax ID requirement.

As an Amazon seller, you may be wondering if you need a tax ID. In this post, we’ll break down what you need to know about tax IDs and Amazon selling. We’ll also provide some tips on how to obtain a tax ID if you don’t have one.

Do I Need an EIN to Sell on Amazon?

If you are thinking about selling products on Amazon, you may be wondering if you need to obtain an employer identification number (EIN) from the IRS.

The answer to this question depends on a few factors, including the type of business you have and the amount of revenue you generate.

If you are sole proprietor or LLC with no employees, you generally will not need to obtain an EIN. However, there are a few exceptions. For example, if you plan on opening a business bank account or applying for business credit, you will likely need to obtain an EIN.

If you have a partnership or corporation, you will need to obtain an EIN. In addition, if you have employees, you will need to obtain an EIN in order to comply with federal employment tax laws.

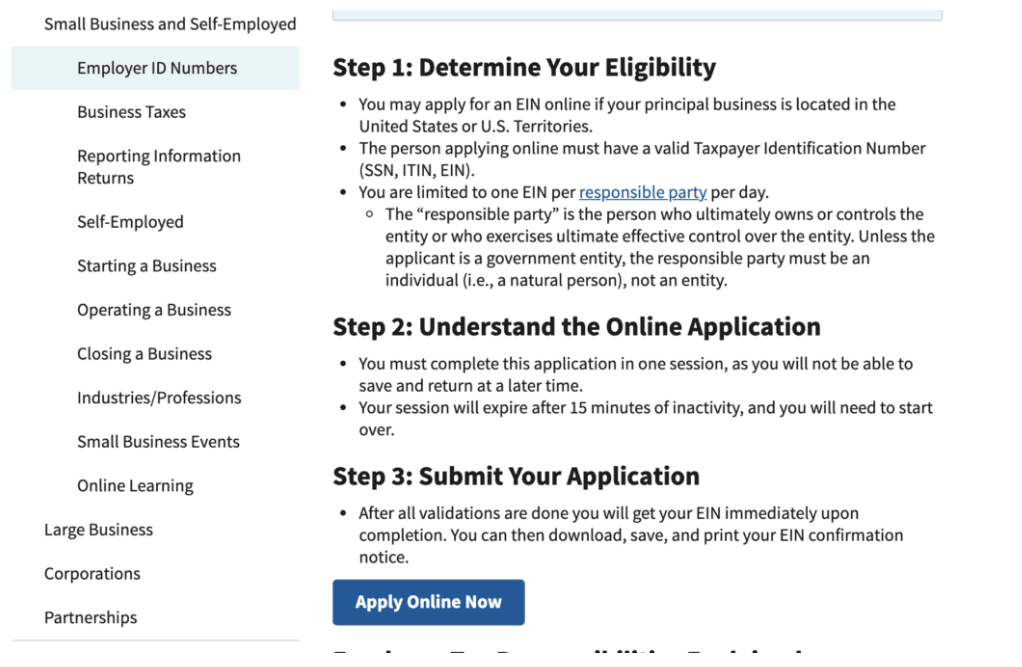

You can apply for an EIN online, by mail, or by fax. The process is relatively simple and takes just a few minutes to complete. Once you have obtained your EIN, you will use it to identify your business for tax purposes.

If you are thinking about selling products on Amazon, make sure you understand the requirements for obtaining an EIN. It is a simple process that will help you ensure compliance with federal tax laws.

Do I Need a Business License?

If you’re starting a business in the United States, you will need to obtain a Tax ID number from the IRS. This number is also known as an Employer Identification Number (EIN). You can apply for an EIN online, by mail, or by fax.

In addition to an EIN, you may also need to obtain a business license from your state or local government. The requirements for obtaining a business license vary from state to state.

You can check with your state’s Secretary of State office or your local Chamber of Commerce to find out what licenses are required in your area.

Once you have obtained your Tax ID number and business license, you can start operating your business. Remember to keep accurate records of your income and expenses so that you can properly file your taxes.

And be sure to comply with all local, state, and federal regulations for running a business.

If you’re thinking about starting a business, there are a few things you need to know about business licenses. In the United States, you will need to obtain a Tax ID number from the IRS.

This number is also known as an Employer Identification Number (EIN). You can apply for an EIN online, by mail, or by fax.

In addition to an EIN, you may also need to obtain a business license from your state or local government. The requirements for obtaining a business license vary from state to state.

You can check with your state’s Secretary of State office or your local Chamber of Commerce to find out what licenses are required in your area.

Once you have obtained your Tax ID number and business license, you can start operating your business. Remember to keep accurate records of your income and expenses so that you can properly file your taxes.

And be sure to comply with all local, state, and federal regulations for running a business.

Do I Need a Sales Tax ID or Permit to sell on Amazon?

You may need a sales tax ID or permit to sell on Amazon, depending on your state’s laws. Check with your state’s tax authority to determine if you need to obtain a license.

If you do need a license, you can apply for one online or in person at your local tax office. Once you have obtained your license, be sure to keep it up to date and renew it as needed.

If you are an Amazon seller who ships products to customers in multiple states, you may need to obtain a sales tax permit for each state in which you do business.

Check with the tax authorities in each state to determine if you need a permit. You can typically apply for a permit online or in person at your local tax office.

Once you have obtained all of the necessary licenses and permits, be sure to keep them up to date and renew them as needed. Failure to do so could result in penalties or fines.

Quick Links

- Can I Have 2 Amazon Seller Accounts

- How Do I Restart My Amazon Seller Account

- 6 Amazon Link Checker Tools

Conclusion- Do I Need A Tax ID To Sell On Amazon 2024 ?

Whether you’re a business or an individual seller, it’s important to understand the tax requirements for selling on Amazon. You may need a Tax Identification Number (TIN) in order to collect and report taxes on your sales.

If you have questions about what type of documentation you need to sell on Amazon, contact your local taxing authority or Amazon Seller Support. We hope this article has helped clear up some of the confusion around tax IDs and selling on Amazon.