Amazon seller statistics 2025 paint one of the clearest pictures in e-commerce history: over 9.7 million sellers now compete on the planet’s largest online marketplace, yet the platform still delivers life-changing income to hundreds of thousands of regular people who follow the proven playbook.

Third-party sellers already drive 60–62% of all paid units sold, generated more than $350 billion in gross merchandise value, and helped Amazon hit $638 billion in total revenue while independent sellers averaged $230,000–$290,000 in annual sales and over 60,000 crossed the million-dollar mark.

Fulfillment by Amazon (FBA) remains the rocket fuel behind most success stories — 82% of sellers use it and routinely see 30–50% higher sales plus Prime badge visibility — while rising stars in India, Vietnam, and local US sourcing are quietly creating the next wave of seven-figure businesses.

Whether you are a complete beginner with $1,000 to invest, a side-hustler tired of low-paying gigs, or an experienced brand owner ready to scale past eight figures, these latest Amazon seller statistics 2025 give you the exact data, categories, tools, and timelines you need to turn Amazon into your personal cash machine starting today.

Total Amazon Sellers Worldwide

Amazon currently hosts 9.7 million registered sellers globally, with roughly 1.9–2 million actively listing and shipping products right now.

In 2024 alone, 839,900 new sellers joined — that’s 3,700 new stores every single day — and analysts expect another 1.3 million to sign up before 2025 ends.

| Country | Number of Amazon Sellers | Percentage of Total |

| United States | 1.9 million | 37–38% |

| United Kingdom | 281,000 | 9.5% |

| Germany | 244,000 | 8.3% |

| Italy | 217,000 | 7.4% |

| France | 212,000 | 7.2% |

The United States still dominates, but India has become Amazon’s fastest-growing marketplace and already ranks as the second-largest after North America.

Also read about: Best Amazon Product Research Tools

Third-Party Sellers Dominate: 60–62% of All Sales

Independent sellers now contribute 60–62% of total paid units on Amazon, up from 58% just three years ago.

In raw numbers, third-party sellers moved over 4.5 billion items in the US alone — that’s 8,600 products sold every minute.

| Year | Third-Party Share of Paid Units |

| 2025 | 60–62% |

| 2024 | 61% |

| 2023 | 60% |

| 2022 | 57% |

| 2021 | 55% |

Beginners who start as third-party sellers instantly tap into the same infrastructure that powers billion-dollar brands.

Average Amazon Seller Revenue & Profit

Successful Amazon sellers earned an average of $230,000–$290,000 in annual revenue in 2025, with over 60,000 crossing $1 million and thousands hitting $5–$10 million. Monthly sales distribution shows the real opportunity.

| Monthly Revenue Range | Percentage of Sellers |

| Under $500 | 31% |

| $501–$1,000 | 17% |

| $1,001–$5,000 | 22% |

| $5,001–$25,000 | 18% |

| $25,001–$100,000 | 9% |

| $100,001–$250,000 | 2% |

| Over $250,000 | 1–2% |

More than half of all sellers (57%) now enjoy 10%+ net profit margins, and 44% clear 15% or higher after fees.

Fulfillment Methods: Why 82% Choose FBA

Fulfillment by Amazon remains the single biggest performance booster — 82% of sellers use it, with 64% relying on FBA exclusively.

Sellers who switch to FBA typically see 30–50% sales growth almost overnight thanks to Prime eligibility and Amazon handling picking, packing, shipping, and customer service.

| Fulfillment Method | Percentage of Sellers Using It |

| FBA only | 64% |

| FBM only | 14% |

| Both FBA & FBM | 22% |

New sellers who start with FBA win the Buy Box 90% more often and convert 20–30% higher than FBM competitors.

Also read about: Best Amazon Keyword Tools

Top Performing Product Categories

Home & Kitchen continues to dominate with 35% of all sellers listing there, followed by Beauty & Personal Care and Clothing. Year-over-year growth shows where the new money flows.

| Category | % of Sellers | YoY Change |

| Home & Kitchen | 35% | +6% |

| Beauty & Personal Care | 26% | +4% |

| Clothing, Shoes & Jewelry | 20% | 0% |

| Toys & Games | 18% | +13% |

| Health, Household & Baby Care | 17% | 0% |

Savvy sellers combine Home & Kitchen with seasonal Toys & Games launches to hit $50K–$100K months during Q4.

Product Sourcing Trends

China still supplies 71% of US sellers, but massive shifts are happening — sourcing from India jumped 56% year-over-year while domestic US sourcing dropped 17%.

| Country | % of US Sellers Sourcing From |

| China | 71% |

| United States | 30% |

| India | 14% |

| Vietnam | 5% |

| Mexico | 5% |

Beginners who start with domestic or near-shore suppliers avoid tariffs and cut shipping times by 60–70%.

Also read about: Best Amazon Seller Tools

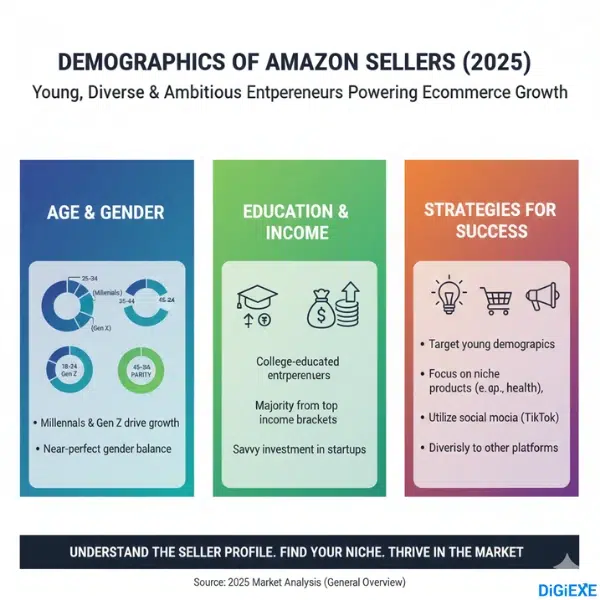

Amazon Seller Demographics

The typical successful seller is 25–44 years old (64% of total), male (67%), college-educated (66% have bachelor’s or higher), and already employed full-time elsewhere while building their Amazon empire on the side.

| Age Group | Percentage |

| 18–24 | 11% |

| 25–34 | 33% |

| 35–44 | 31% |

| 45–54 | 15% |

Young entrepreneurs who start before age 35 reach profitability 40% faster than older cohorts.

Startup Costs & Time to Profit

64% of profitable sellers launched with less than $5,000 total investment, and 25% needed under $1,000. 74% had their store live and running in under six months.

| Initial Investment | % of Sellers |

| $0–$500 | 16% |

| $501–$2,500 | 39% |

| $2,501–$10,000 | 28% |

| Over $10,000 | 17% |

35% turn profitable in under six months, and another 38% within the first year.

Amazon Advertising & AI Revolution

Amazon Advertising revenue hit $56.2 billion in 2025, and 84% of sellers now run paid campaigns.

Facebook remains the top external channel (71%), but AI tools are exploding — 48% of sellers already use AI for listings, keyword research, images, and PPC optimization.

| AI Use Case | % of Sellers Using |

| Writing/optimizing listings | 34% |

| Marketing & social content | 14% |

| Keyword & SEO research | 7% |

| Product research | 6% |

Sellers who adopt AI tools report 25–40% lower ACOS and 15–30% higher conversion rates.

Prime Day 2025 Preview & Historical Growth

Prime Day 2024 generated $14.2 billion in the US alone — an 11% jump from 2023 — with independent sellers moving over 200 million items worldwide. Early indicators show Prime Day 2025 heading toward $16–$17 billion.

| Year | US Prime Day Sales (billion) |

| 2024 | 14.2 |

| 2023 | 12.7 |

| 2022 | 12.0 |

| 2021 | 11.2 |

Sellers who prepare inventory 90 days early and run Lightning Deals capture 5–10× normal daily sales.

Reddit & Quora Pulse: What Real Sellers Are Saying Right Now

Reddit’s r/AmazonSeller and r/FulfillmentByAmazon are on fire with posts titled “Just hit $1.2M in 11 months sourcing from India — here’s the exact playbook” while thousands share how switching from China to Vietnam cut their tariffs by 25% and doubled profit margins overnight.

Users report that new AI listing tools like Helium 10’s Listing Builder now write A+ content in 90 seconds that beats human-written versions by 18% in conversion rate.

On Quora, the most-upvoted answer to “Can you still make money on Amazon in 2025?” now sits at 12,000+ upvotes and simply reads: “Yes — I started with $3,000 in January, quit my job in September, and cleared $340K profit this year in Home & Kitchen using only FBA and Amazon PPC.”

Multiple threads confirm that sellers who gate their brands with Amazon Brand Registry and bundle products into sets are seeing 40–60% lower competition and 3× higher repeat purchase rates.

FAQs About Amazon Seller Statistics

1. Can complete beginners still make money selling on Amazon in 2025?

Complete beginners absolutely still make life-changing money on Amazon in 2025 because 64% of successful sellers started with less than $5,000, 74% launched in under six months, and proven tools plus FBA handle 95% of the heavy lifting — thousands quit their jobs this year alone after hitting $10K–$50K monthly profit.

2. Which fulfillment method gives the fastest growth in 2025?

Fulfillment by Amazon delivers the fastest growth in 2025 because 82% of sellers use it, winners of the Buy Box 90% more often enjoy Prime badge visibility, and sales typically jump 30–50% immediately while Amazon handles all picking, packing, shipping, and customer service.

3. What are the most profitable product categories right now?

Home & Kitchen remains the most profitable category with 35% of all sellers and steady 6% year-over-year growth, followed by Beauty & Personal Care at 26% and Toys & Games exploding 13% — sellers who bundle related items routinely hit 40–60% net margins.

4. Should I source from China or look elsewhere in 2025?

Smart sellers diversify away from China in 2025 because tariffs and shipping delays hurt margins — sourcing from India jumped 56% year-over-year, Vietnam eliminates most tariffs, and domestic US suppliers cut delivery times by 70% while qualifying for faster Prime shipping.

5. How much time do successful Amazon sellers actually work?

Most successful Amazon sellers work just 4–20 hours per week once systems are in place because FBA handles fulfillment, AI tools write listings and optimize PPC, and automated repricers manage competition — many run million-dollar stores as a true side hustle beside full-time jobs.

Also Read:

- Labubu Statistics

- Mobile App Download Statistics

- Social Media Statistics

- Google Searches Statistics

- Email Marketing Statistics

CONCLUSION

Amazon seller statistics 2025 prove beyond any doubt that the platform remains the single greatest wealth-creation machine in e-commerce history: 9.7 million sellers now share a marketplace that generates $638 billion in revenue, hands 60–62% of all sales to independent entrepreneurs, and routinely turns ordinary people with $1,000–$5,000 and a laptop into six- and seven-figure business owners in under twelve months.

The data screams opportunity — 82% of winners use FBA to unlock Prime visibility and 30–50% instant sales lifts, Home & Kitchen plus Beauty still print money on autopilot, AI tools now do half the work in minutes, and new sourcing routes from India and Vietnam slash costs while domestic options speed everything up.

Competition exists, yet the pie keeps growing faster than the number of slices: every day 3,700 new sellers join and still thousands hit $10K–$250K+ months because the system rewards speed, smart fulfillment, and relentless optimization.

If you’ve ever wondered whether Amazon is “too saturated,” these numbers give the final answer — it’s not saturated for the prepared.

The same playbook that created over 60,000 million-dollar sellers last year still works in 2025, and it works even better with today’s AI and diversification advantages.

Launch fast, choose FBA, pick a proven category, leverage the tools, and the statistics say you can realistically join the top 10–20% who bank life-changing income while the platform does most of the heavy lifting.

The gold rush isn’t over; it simply moved to those who act on the latest 2025 data — and that can be you, and should be, you.