Since its launch in November 2019, Disney Plus has rapidly evolved into one of the leading streaming platforms worldwide.

With its unique combination of beloved family-friendly content, blockbuster Marvel films, and iconic Star Wars series, Disney Plus has amassed millions of loyal subscribers.

As of 2025, the platform continues to thrive, despite facing competitive pressures and fluctuating market dynamics.

In this article, we’ll break down the latest Disney Plus statistics for 2025, focusing on subscriber growth, revenue performance, key content strategies, and the future outlook of the platform.

Whether you’re a subscriber or an investor, understanding the figures behind Disney Plus’s performance can provide valuable insights into its ongoing success.

Disney Plus Subscriber Growth: A Remarkable Trajectory

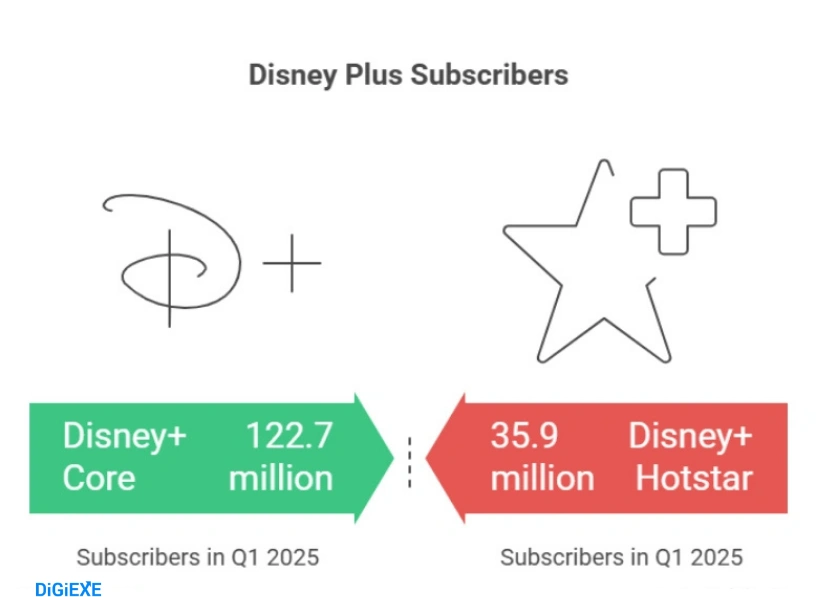

Disney Plus has enjoyed impressive growth since its inception. In just six years, the platform has grown from an initial 10 million subscribers to a significant 128 million core users globally in 2025.

The platform’s success can be attributed to its unique content offering, its ability to cater to various age groups, and its expansive brand power.

Disney Plus now operates in over 150 countries, providing users access to a massive library of TV shows, movies, and exclusive content.

Subscriber Growth Milestones

The journey of Disney Plus’s subscriber base has been one of rapid expansion, especially during the pandemic era when streaming services saw an unprecedented spike in demand.

In April 2020, Disney Plus had already crossed 50 million subscribers, a milestone that reflected both the growing appeal of its content and the global demand for entertainment during lockdowns.

However, subscriber numbers were not always smooth sailing—there were periods of growth, as well as moments of setback, such as when price hikes and content controversies led to minor subscriber losses.

Here’s an overview of the most significant milestones in subscriber growth:

| Quarter | Core Subscribers (Millions) | Total Subscribers (Including Hotstar, Millions) | Growth Factors |

|---|---|---|---|

| Q1 2021 | 94.9 | N/A | Launch excitement |

| Q2 2021 | 103.6 | N/A | WandaVision debut |

| Q3 2021 | 116.0 | N/A | Loki series |

| Q4 2021 | 118.1 | N/A | Holiday bundling |

| Q1 2022 | 129.8 | N/A | Turning Red film |

| Q2 2022 | 137.7 | N/A | Obi-Wan Kenobi series |

| Q3 2022 | 152.1 | N/A | Andor success |

| Q4 2022 | 164.2 | N/A | Holiday season specials |

| Q1 2023 | 161.8 | N/A | Price hikes |

| Q2 2023 | 157.8 | N/A | Ad-tier introduction |

| Q3 2023 | 146.1 | N/A | Churn from price hikes |

| Q4 2023 | 150.2 | N/A | Guardians Holiday Special |

| Q1 2024 | 149.6 | 185.5 | Hotstar integration |

| Q2 2024 | 153.6 | 189.1 | Inside Out 2 buzz |

| Q3 2024 | 153.8 | 189.3 | Deadpool & Wolverine crossover |

| Q4 2024 | 158.6 | 194.5 | Holiday bundling surge |

Fluctuations in Subscriber Numbers: Managing Growth and Setbacks

Despite its rapid growth, Disney Plus has faced some volatility in terms of subscriber retention. Price hikes, content controversies, and strategic shifts have resulted in fluctuations in subscriber numbers.

For instance, in Q1 2025, Disney Plus experienced a slight decline of 700,000 subscribers, partly due to the price increase from $13.99 to $15.99, and the suspension of Jimmy Kimmel Live! on ABC, which sparked widespread backlash and the #BoycottDisney movement.

Major Subscriber Changes

By Q2 2025, Disney Plus managed to recover, gaining 1.8 million new subscribers, driven by popular film releases like Moana 2 and Mufasa: The Lion King.

In Q3, subscriber numbers grew further to 127.8 million, benefiting from big crossover events like Deadpool and Wolverine.

Projections for Q4 2025 suggest a significant 4.4 million new subscribers, driven by holiday content and continued enforcement of password-sharing crackdowns.

| Quarter | Net Subscriber Change (Millions) | Total Subscribers (Millions) | Key Growth Drivers |

|---|---|---|---|

| Q1 2025 | -0.7 | 124.6 | Price hikes; Kimmel suspension |

| Q2 2025 | +1.8 | 126.4 | Moana 2, Mufasa premieres |

| Q3 2025 | +1.4 | 127.8 | Daredevil premieres; Boycott effect |

| Q4 2025 (proj.) | +4.4 | 132.2 | Holiday content, password crackdown |

Who’s Watching Disney Plus? Demographics Breakdown

Understanding the demographics of Disney Plus’s user base provides insights into how the platform tailors its content offerings.

Disney Plus is widely popular among families, young adults, and nostalgia-driven viewers.

The platform’s success is largely due to its family-friendly content and its appeal to multiple age groups.

Age Demographics

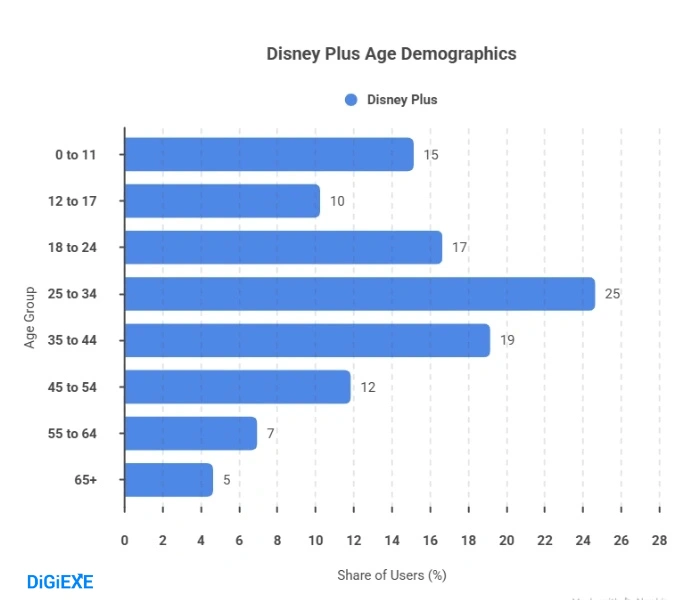

Disney Plus subscribers are predominantly younger, with a significant portion of the user base between the ages of 25 and 44.

This aligns with the platform’s appeal to young adults, parents, and families looking for kid-friendly content.

Below is a breakdown of the age demographics:

| Age Group | Share of Subscribers | Recommended Content |

|---|---|---|

| 0-11 years | 15.2% | Pixar movies and educational shows |

| 12-17 years | 10.3% | Teen-centric shows, like Zombies |

| 18-24 years | 16.7% | Marvel movies and Star Wars |

| 25-34 years | 24.7% | Star Wars deep dives |

| 35-44 years | 19.2% | Family bundles with Hulu |

| 45-54 years | 11.9% | The Simpsons and nostalgic content |

| 55-64 years | 7.0% | National Geographic documentaries |

| 65+ years | 4.7% | Classic Disney films |

Gender Demographics

The gender split among Disney Plus subscribers is relatively balanced, with 55% of U.S. users identifying as male and 45% as female.

This reflects the platform’s broad content appeal, which spans everything from action-packed Marvel series to family-friendly animated films.

Financial Health of Disney Plus

Disney Plus has become a significant revenue driver for The Walt Disney Company. In 2024, Disney Plus generated a robust $10.4 billion in total revenue, marking a 21.6% year-over-year increase.

As Disney continues to refine its content strategies, including offering both premium and ad-supported subscription options, it’s positioning itself for long-term financial success.

Disney Plus Revenue Breakdown

Disney Plus’s revenue growth is attributed to a combination of higher Average Revenue Per User (ARPU) and increased ad-supported subscription adoption.

Disney is also investing heavily in content, spending between $14-16 billion annually to produce original films and series. For 2025, Disney Plus is on track to generate $11.2 billion in revenue.

| Year | Revenue ($ Billions) | ARPU | Year-over-Year Growth (%) |

|---|---|---|---|

| 2020 | 2.8 | 5.50 | N/A |

| 2021 | 5.3 | 6.20 | 89.3 |

| 2022 | 7.4 | 6.50 | 39.6 |

| 2023 | 8.4 | 6.70 | 13.5 |

| 2024 | 10.4 | 7.20 | 23.8 |

| 2025 (proj.) | 11.2 | 7.55 | 7.7 |

The platform’s ARPU rose to $7.20 in Q4 2024, driven by the adoption of premium subscriptions and increasing demand for exclusive content.

The ad-supported tiers, which now account for 30% of global subscribers, continue to contribute positively to Disney Plus’s financial growth.

Competitive Landscape: Disney Plus’s Market Share

In the highly competitive streaming industry, Disney Plus holds a solid position, ranking fourth in the U.S. subscription video-on-demand (SVOD) market.

However, it faces stiff competition from services like Amazon Prime Video and Netflix, which each hold larger market shares.

| Platform | Market Share | Subscribers (Millions) | Strengths for Users |

|---|---|---|---|

| Amazon Prime Video | 22% | 200+ | Bundled with shopping perks |

| Netflix | 21% | 280 | Original content variety |

| Max | 13% | 100 | HBO prestige |

| Disney Plus | 12% | 128 | Family, MCU exclusives |

| Hulu | 10% | 55.5 | Live TV, current shows |

While Disney Plus has gained significant traction, it still trails behind Netflix and Amazon Prime Video in terms of global reach. However, Disney Plus’s unique family-centric content and brand appeal give it an edge in the streaming wars.

Maximizing Your Disney Plus Subscription

To get the most out of your Disney Plus subscription in 2025, consider these strategies:

- Leverage Bundles: Opt for bundled subscriptions with Hulu or ESPN+ to save up to 40%. You’ll enjoy access to more diverse content and exclusive offerings across multiple platforms.

- Sign Up During Major Content Drops: Time your subscription around the release of highly anticipated shows or movies, like Daredevil: Born Again or new Marvel phases.

- Use Download Features for Offline Viewing: Disney Plus allows you to download content for offline viewing—great for travel or long commutes, saving on data costs.

FAQs About Disney Plus Statistics

1. How many subscribers does Disney Plus have globally in 2025?

As of mid-2025, Disney Plus has approximately 128 million core subscribers globally, with total subscribers reaching 163.9 million including Hotstar.

2. What is Disney Plus's total revenue for 2024?

Disney Plus generated $10.4 billion in total revenue in 2024, marking a 21.6% increase compared to 2023.

3. What age group makes up the largest share of Disney Plus users?

The largest group of users is aged 25-44, comprising 43.9% of the total subscriber base.

4. What is Disney Plus’s market share in the U.S. SVOD market?

Disney Plus holds a 12% share of the U.S. SVOD market, ranking fourth behind Amazon Prime Video, Netflix, and Max.

5. How can users make the most of their Disney Plus subscription?

Users can save money by opting for ad-supported bundles, timing subscriptions for major content drops, and downloading content for offline viewing.

Also Read:

- Digital PR Statistics 2026

- Live Streaming Statistics 2026

- Screen Time Statistics 2026

- Virtual Reality Statistics 2026

- Link Building Statistics for 2026

Conclusion

Disney Plus continues to hold a strong position in the streaming world, with robust subscriber growth, increasing revenue, and a powerful content library.

While the platform faces some challenges, such as price hikes and subscriber churn, its ability to adapt through strategic content drops, ad-supported tiers, and bundling options shows its potential for continued success.

Whether you’re a casual viewer or a devoted Disney fan, these statistics paint a bright future for Disney Plus in 2025 and beyond.