In 2025, cryptocurrency has firmly moved from the fringes into everyday finance. Approximately 559 million people worldwide now own digital assets, representing a solid 9.9% of the global internet population.

This marks an extraordinary journey from just 420 million owners in 2023 to over half a billion today.

Businesses, governments, and individuals increasingly use Bitcoin, Ethereum, stablecoins, and thousands of other tokens for payments, remittances, savings, and investments.

This comprehensive guide dives deep into the latest global crypto adoption statistics 2025, shows who owns crypto, which countries lead, how wealth is being created, and—most importantly—how everyday people and businesses can benefit from this historic shift.

Current Global Crypto Ownership Snapshot

Around 559.4 million people own cryptocurrency in 2025, according to consolidated data from Triple-A, Datareportal, and TRM Labs.

This number grew 33% year-over-year despite market volatility.

| Metric | 2025 Value | Change from 2024 |

| Total crypto owners worldwide | 559–562 million | +33% |

| Global adoption rate | 9.9% of internet users | –0.4 pp from 2023 peak |

| Total crypto market cap | $2.96 trillion | +89% |

| Projected market cap by 2030 | $7.98 trillion (CAGR 30.1%) | — |

| Bitcoin millionaires | 192,205 | +123% from 2024 |

| Crypto billionaires | 28 | +27% |

The slight dip in the percentage rate from 10.3% in early 2023 to 9.9% today is explained by the internet population growing faster than crypto onboarding in some mature markets.

However, absolute numbers continue to explode.

Also read about: Altcoin Statistics 2026

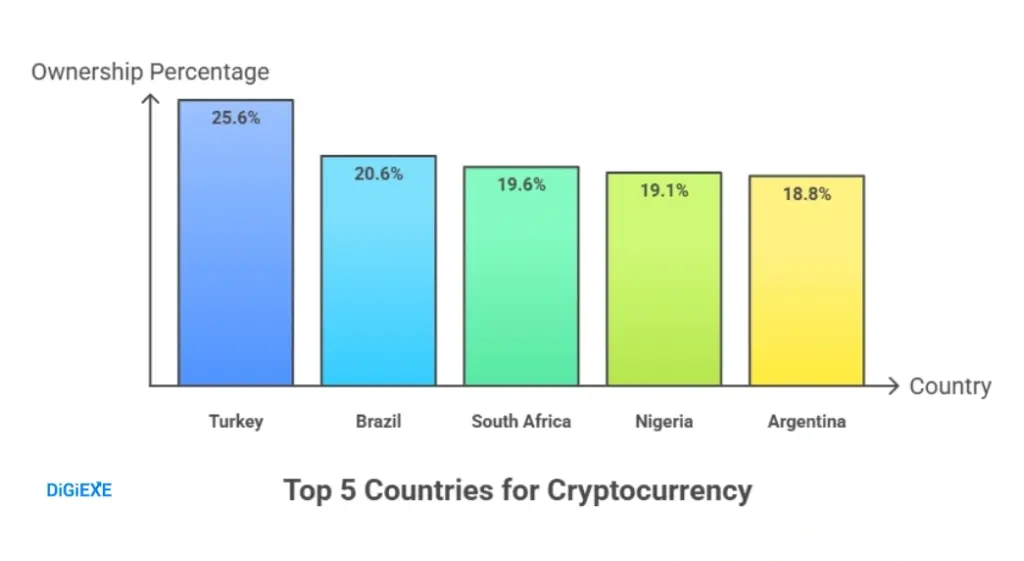

Top Countries by Crypto Ownership Rate

Emerging markets continue to dominate adoption when measured as a percentage of population.

| Rank | Country | % of Population Owning Crypto | Key Driver |

| 1 | Turkey | 25.6% | High inflation hedge & remittances |

| 2 | Brazil | 20.6% | Financial inclusion & Pix integration |

| 3 | South Africa | 19.6% | Youth unemployment & store of value |

| 4 | Nigeria | 19.1% | P2P trading & dollar shortage |

| 5 | Argentina | 18.8% | 200%+ inflation protection |

| 6 | Netherlands | 17.8% | High disposable income & tech culture |

| 7 | U.A.E. | 16.9% | Crypto-friendly regulation |

| 8 | Portugal | 16.3% | Golden visa & tax advantages |

| 9 | Norway | 15.7% | Wealthy population & energy abundance |

| 10 | Switzerland | 15.1% | Crypto Valley Zug & banking integration |

Source: Datareportal & Triple-A 2025 reports

TRM Labs’ on-chain + web-traffic adoption index tells a slightly different story when adjusted for GDP per capita (PPP).

India remains #1 for the third year running, followed by the United States, Pakistan, Philippines, and Brazil—highlighting massive grassroots activity in developing economies.

Also read about: Most Expensive NFTs Sold Statistics 2026

Crypto Adoption by Age and Gender

Men aged 25–34 remain the most active demographic worldwide.

| Age Group | Male Ownership | Female Ownership |

| 16–24 | 13.5% | 6.0% |

| 25–34 | 16.2% | 8.7% |

| 35–44 | 14.1% | 7.8% |

| 45–54 | 11.2% | 6.0% |

| 55–64 | 7.7% | 4.9% |

| 65+ | 3.2% | 1.8% |

Across every age bracket, men own crypto at roughly double the rate of women. However, female adoption is growing fastest in the 25–34 segment, up almost 20% year-over-year according to recent Reddit and Quora discussions.

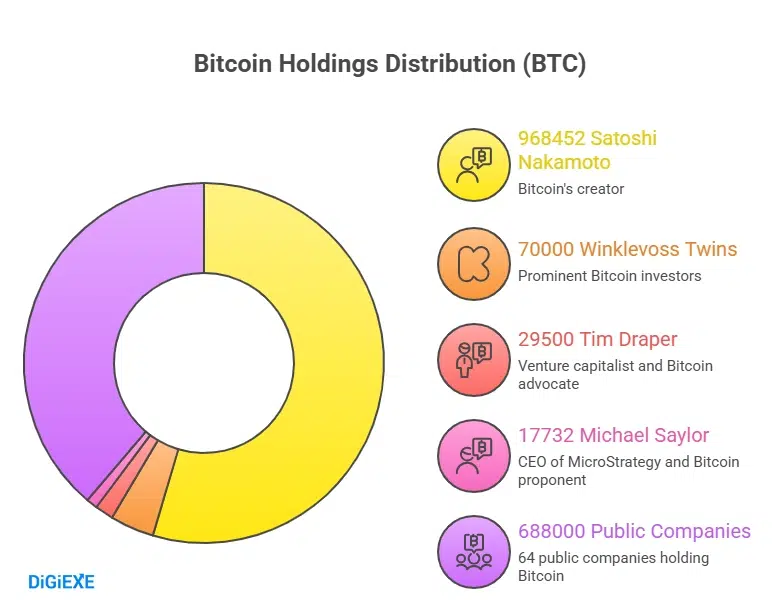

Who Holds the Most Bitcoin in 2025?

| Rank | Holder / Entity | BTC Held | Approx. Value (Nov 2025) | Notes |

| 1 | Satoshi Nakamoto | 968,452 | $110 billion | Completely dormant except one 2025 move |

| 2 | MicroStrategy (corporate) | 597,325–632,457 | $68–72 billion | Largest public company holder |

| 3 | Binance cold wallets | 248,600 | $28 billion | Exchange reserves |

| 4 | U.S. Government | 207,189 | $23.5 billion | Mostly from seizures |

| 5 | China (gov seized) | ~190,000 | $21 billion | PlusToken & other cases |

| 6 | Winklevoss Twins | ~70,000 | $8 billion | Gemini founders |

The top 1% of Bitcoin addresses still control ~87% of all BTC supply—an often-criticized but persistent reality of the network.

Bitcoin and Crypto Millionaires Explosion

2025 delivered the biggest wealth-creation event in crypto history so far:

- Bitcoin millionaires grew from 85,400 (2024) → 192,205 (2025) = +125%

- Centi-millionaires ($100 M+) rose from 156 → 325 = +108%

- Crypto billionaires rose from 22 → 28 = +27%

During the first six months of the Trump administration (Jan–July 2025), 26,758 new Bitcoin millionaires were created—an average of 148 new millionaires every single day.

Stablecoins: The Real Engine of Everyday Adoption

Stablecoins now power the majority of real-world crypto use.

- Stablecoins represent 30% of all on-chain transaction volume in 2025

- Annual stablecoin volume surpassed $4 trillion by August 2025 (+83% YoY)

- 76% of crypto payments are made in stablecoins (mostly USDT & USDC)

- 46% of surveyed merchants worldwide now accept crypto payments

- 43% of e-commerce platforms support crypto checkout

Reddit and Quora users in 2025 frequently ask: “Which stablecoin is safest for remittances?” The overwhelming community answer is USDC for transparency and USDT for liquidity and global reach.

United States: From Regulatory Uncertainty to Crypto Superpower

21% of U.S. adults (≈55 million people) own cryptocurrency in 2025. Spot Bitcoin ETFs attracted over $65 billion in net inflows since launch. The passage of the GENIUS Act (stablecoin framework) and the appointment of a national “Crypto Tsar” have dramatically increased institutional and institutional confidence.

How Individuals Can Benefit from Global Crypto Adoption in 2025 and Beyond

- Inflation Hedge – Residents of Turkey, Argentina, Nigeria, and Lebanon continue to use Bitcoin and stablecoins to protect savings from 50–200% annual inflation.

- Lower-Cost Remittances – A worker in the Philippines receiving money from the U.S. via USDC on Solana or Tron pays 0.3–1% instead of Western Union’s 6–12%.

- Yield Opportunities – Staking, lending, and liquidity providing on DeFi platforms routinely offer 4–12% APY in stablecoins—far higher than traditional savings accounts.

- Global Freelance Payments – Upwork, Fiverr, and many Web3-native platforms now pay directly in USDT/USDC, bypassing bank delays and FX fees.

- Merchant Sales Growth – Shops that add crypto payments report 15–30% higher average order values (Travala saw crypto travelers spend 2.5× more than card users).

Latest Insights from Reddit & Quora Communities (November 2025)

Recent hot threads reveal what real users care about right now:

- “Best country to move to for crypto taxes in 2025?” → Portugal, UAE, and El Salvador dominate answers.

- “Is crypto still worth starting in late 2025?” → Overwhelming consensus: “Yes—adoption is only 9.9% globally; we are still extremely early.”

- “Which chain has the cheapest fees for daily spending?” → Solana, Tron, and Base are the top three answers in 2025.

- “Can I pay rent/mortgage with crypto yet?” → Growing number of property managers in Miami, Dubai, Lisbon, and Buenos Aires now accept USDT/BTC directly.

FAQs About Crypto Adoption Statistics

1. How many people own cryptocurrency worldwide in 2025?

Approximately 559–562 million people own cryptocurrency in 2025, representing about 9.9% of the global internet population and roughly 7% of the total world population.

2. Which country has the highest crypto adoption rate in 2025?

Turkey leads with 25.6% of its population owning cryptocurrency, followed closely by Brazil (20.6%) and South Africa (19.6%).

3. Is cryptocurrency adoption still growing in 2025 after the bull run?

Yes, absolute ownership grew 33% year-over-year, and on-chain transaction volume (especially stablecoins) is up over 80%. Percentage penetration dipped slightly only because the internet population grew even faster.

4. Are stablecoins safe for everyday use and remittances?

Regulated stablecoins such as USDC and USDT are widely considered safe for day-to-day transactions in 2025. USDC offers full transparency with monthly attestations, while USDT dominates liquidity on most exchanges and payment corridors.

5. Should I start investing in crypto in late 2025 or is it too late?

With global adoption still under 10%, most analysts and community members agree we remain in the very early innings—similar to the internet in 1997–1999. Long-term growth projections remain extremely positive.

Also Read:

- Meeting Statistics

- Mobile Internet Traffic Statistics

- Google Chrome Statistics

- AI Recruitment Statistics

- Content Marketing Statistics

Conclusion

Global crypto adoption in 2025 stands at an inflection point. More than half a billion people—roughly the population of the European Union plus the United States combined—actively own and use digital assets.

Emerging markets lead in percentage terms because crypto solves real problems: inflation, expensive remittances, and lack of banking access.

Meanwhile, developed nations lead in absolute capital flows, institutional participation, and regulatory clarity.

Stablecoins have become the bridge that turns volatile tokens into practical everyday money, powering everything from freelance salaries to luxury purchases.

The data is clear: crypto is no longer a speculative experiment. It is a global financial rail that is growing faster than the internet did at a comparable stage.

Whether you are an individual looking to protect your savings, a freelancer wanting faster cheaper payments, or a business owner aiming to reach new customers, the infrastructure is ready in 2025.

The next billion users are coming—and they will arrive much faster than the first 559 million.

Source: Statista, Security.org