Are you looking for ways to turn a small amount of money into a larger sum? If so, you’re in luck. There are several easy methods you can use to grow your initial investment. By following these tips, you can turn 10,000 into 100,000 in no time. So what are you waiting for? Start building your fortune today!

7 Ways To Turn 10K Into 100K- Ultimate Guide

1. Invest in Real Estate with Fundraise

If you’re looking for a way to invest in real estate without the hassle of being a landlord, Fundrise may be the perfect solution for you. With Fundrise, you can invest in a diversified portfolio of properties and receive regular distributions from your investment. And best of all, because Fundraise is an equity crowdfunding platform, you can get started with as little as $500.

So what are you waiting for? If you’re looking for a simple and effective way to invest in real estate, head over to Fundraise today and see what they have to offer. You won’t be disappointed.

2. Invest in Index Funds

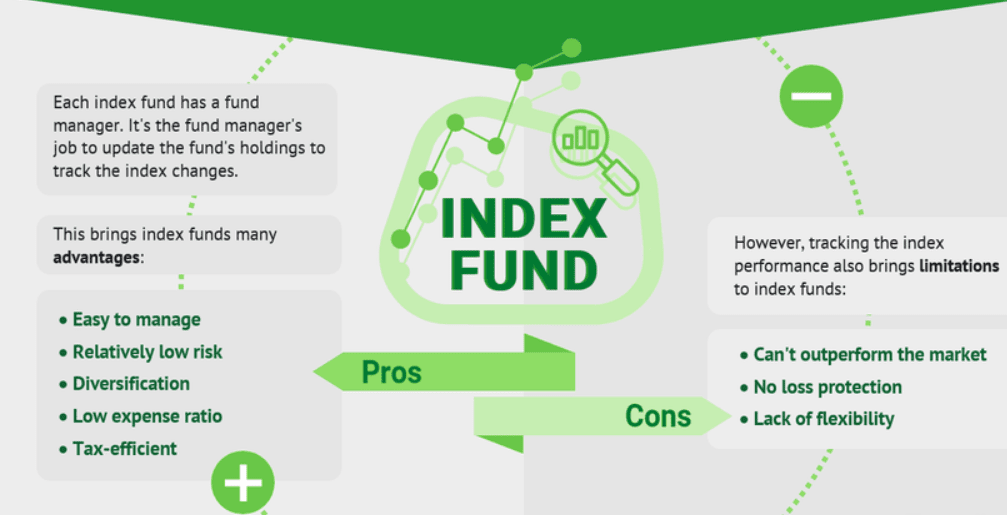

Over the past decade, index funds have become increasingly popular with investors. And for good reason – they offer a number of benefits that make them an attractive option for many people.

Index funds are diversified, meaning that they offer exposure to a wide range of different assets. This can help to protect against the risks associated with investing in any single asset.

Additionally, index funds tend to be lower cost than other types of investments, making them a more efficient way to grow your portfolio.

Finally, index funds are generally less volatile than other types of investments, which can help to reduce the overall risk of your investment portfolio. For all of these reasons, index funds can be an excellent addition to any investor’s portfolio.

3. Invest in Mutual Funds

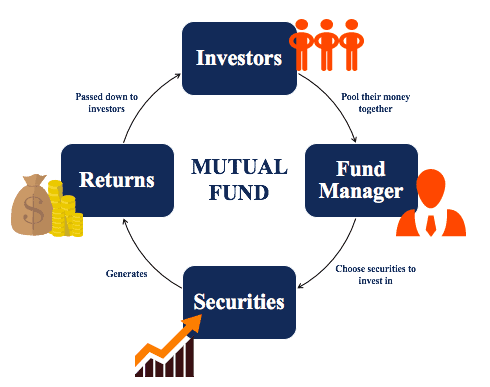

Many people choose to invest in mutual funds as a way to save for retirement or other long-term financial goals. While there are a variety of different types of mutual funds available, they all work in essentially the same way.

When you invest in a mutual fund, your money is pooled with the money of other investors and used to purchase a variety of securities, such as stocks, bonds, or cash equivalents.

The performance of the fund is based on the performance of the securities it holds. One of the main benefits of investing in mutual funds is that it allows you to diversify your portfolio without having to purchase individual securities.

This can help to reduce risk and improve returns over time. Another benefit is that mutual funds are managed by professional money managers who are skilled in selecting successful investments.

If you are considering investing in mutual funds, be sure to do your research and choose a fund that aligns with your investment objectives.

4. Invest in ETFs

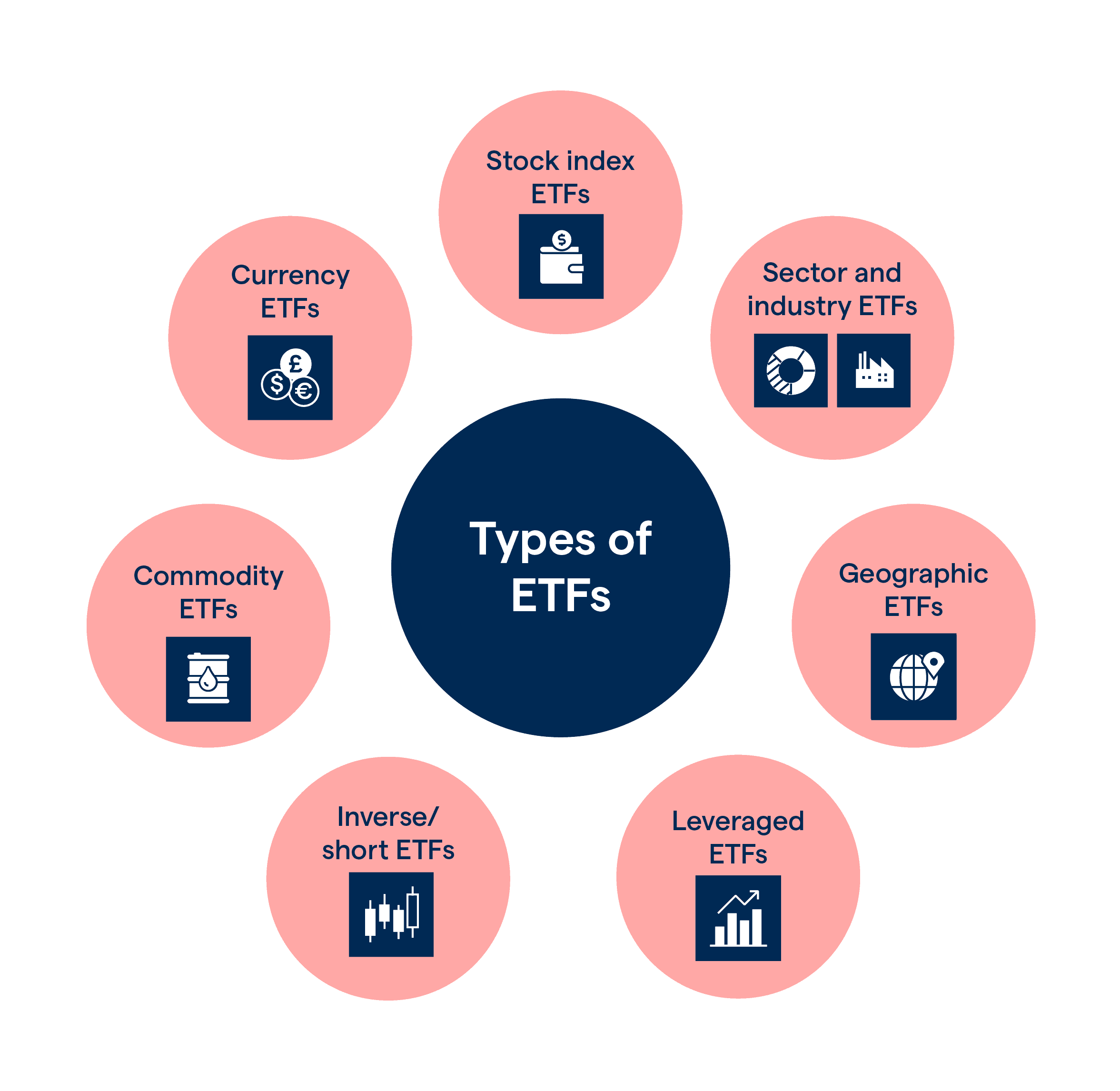

Exchange-traded funds (ETFs) have become increasingly popular in recent years, and for good reason. ETFs are a type of investment fund that trades on a stock exchange, and they offer a number of advantages over other types of investments.

For one, ETFs tend to be more diversified than traditional mutual funds, which can help to reduce risk. In addition, ETFs often have lower fees than mutual funds, and they are more tax-efficient.

Finally, ETFs offer greater flexibility than most other types of investments, allowing investors to buy and sell them throughout the day. Given all of these advantages, it’s no wonder that ETFs have become so popular.

If you’re looking for a way to invest in the market, ETFs are definitely worth considering.

5. Invest in Dividend Stocks

Many investors choose to invest in dividend stocks as a way to generate passive income. A dividend stock is a stock that pays out a periodic dividend, typically on a quarterly basis.

The dividend is often paid out of the company’s profits, and it can be either fixed or variable. For many investors, dividend stocks are an attractive option because they offer the potential for both capital appreciation and regular income.

Indeed, over time, the value of the stock may rise, providing the opportunity for investors to sell their shares at a profit. At the same time, the regular dividend payments can provide a valuable source of income, even if the stock price remains unchanged.

As such, dividend stocks can be an attractive option for those seeking to build a diversified investment portfolio.

6. Retirement Investment Accounts

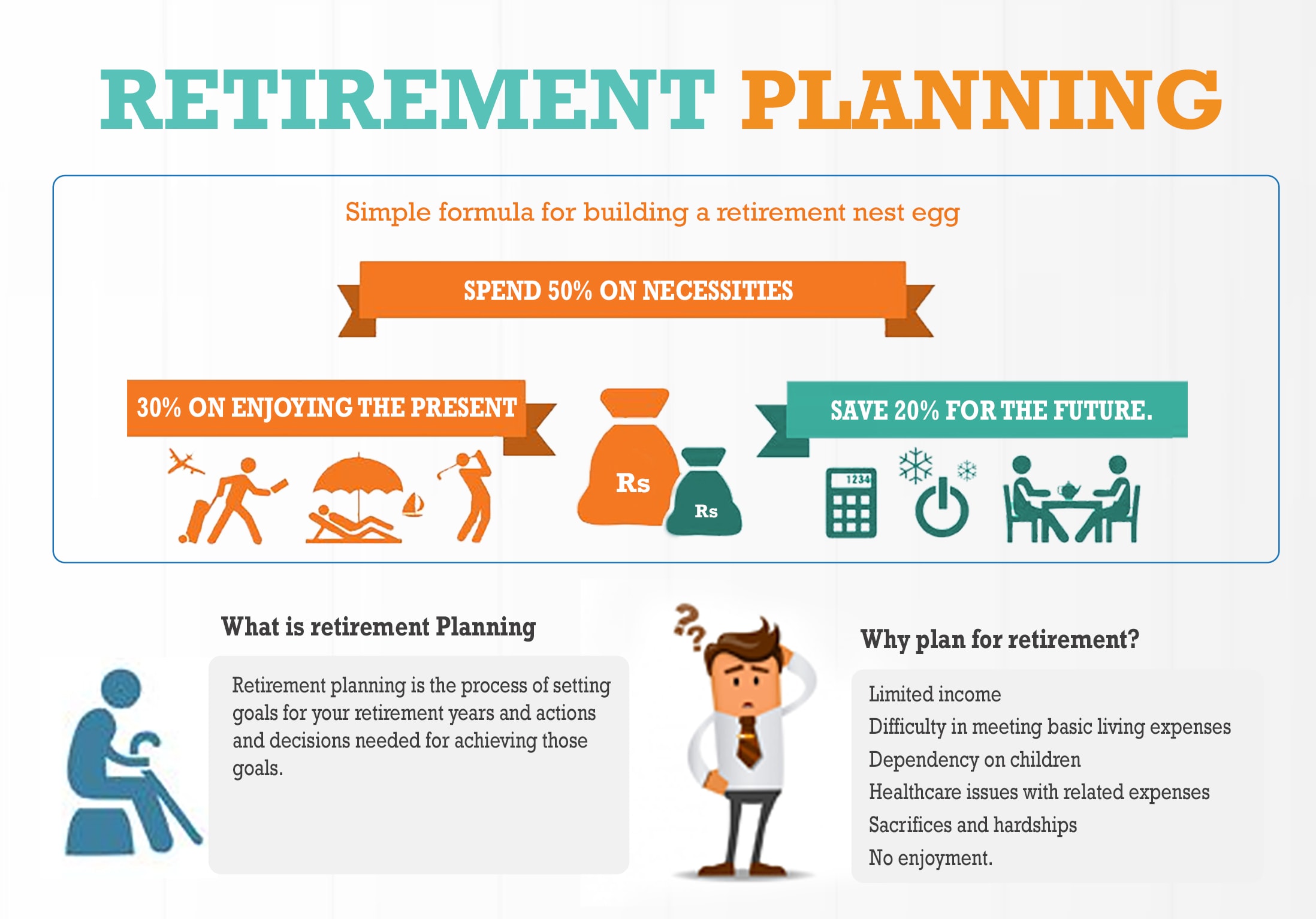

One of the most important decisions you will make during your working years is how to save for retirement. There are many different retirement investment accounts available, each with its own benefits and drawbacks.

The type of account you choose should be based on your unique circumstances and financial goals. For example, if you are looking for immediate tax breaks, a traditional IRA or 401(k) may be the best choice.

However, if you are willing to wait until retirement to reap the rewards, a Roth IRA may be a better option. No matter which type of account you choose, the key is to start saving early and contribute as much as possible.

By taking advantage of compound interest and market growth, you can ensure that you will have the resources you need to enjoy a comfortable retirement.

7. Purchase a Rental Property

Renting a property can be a great way to generate extra income, but it’s important to do your homework before you take the plunge. There are a few things you should keep in mind when considering purchasing a rental property.

First, it’s important to find a property in a desirable location. This will help ensure that you have no trouble finding tenants. Second, be sure to factor in all of the costs associated with owning a rental property, such as mortgage payments, insurance, repairs, and upkeep.

Finally, it’s always a good idea to consult with a professional before making any major real estate decisions. By following these simple tips, you can be sure that purchasing a rental property is a wise investment.

Quick Links

- How To Make Money With Affiliate Marketing? Best Guide

- Spocket Dropshipping Review: Is It Worth The Money? (WHY)

- WebinarJam Vs WebinarNinja: Which One Is To Choose &; Why?

Conclusion- 7 Easy Ways To Turn 10K Into 100K- Ultimate Guide 2026

It is possible to turn a small investment into a large sum of money, but it takes time and effort. By starting off with a small amount of money and reinvesting your profits, you can slowly grow your business until it is worth six figures. Have you started a business on a small budget? Share your story in the comments below!