Altcoin statistics 2025 paint a picture of a market on the brink of transformation, where savvy investors who understand the data position themselves to capture life-changing gains while avoiding the traps that wipe out 90% of speculative plays.

With over 18,507 cryptocurrencies tracked across 1,415 exchanges and the total crypto market cap hovering at $3.94 trillion, altcoins command a commanding 43.7% slice – that’s $1.72 trillion in combined value powering everything from DeFi protocols to meme-fueled communities.

Ethereum leads the pack with a $517.52 billion market cap, but rising stars like Solana ($96.88 billion) and XRP ($170.59 billion) signal a rotation that’s delayed yet inevitable, potentially igniting the most explosive altseason since 2021.

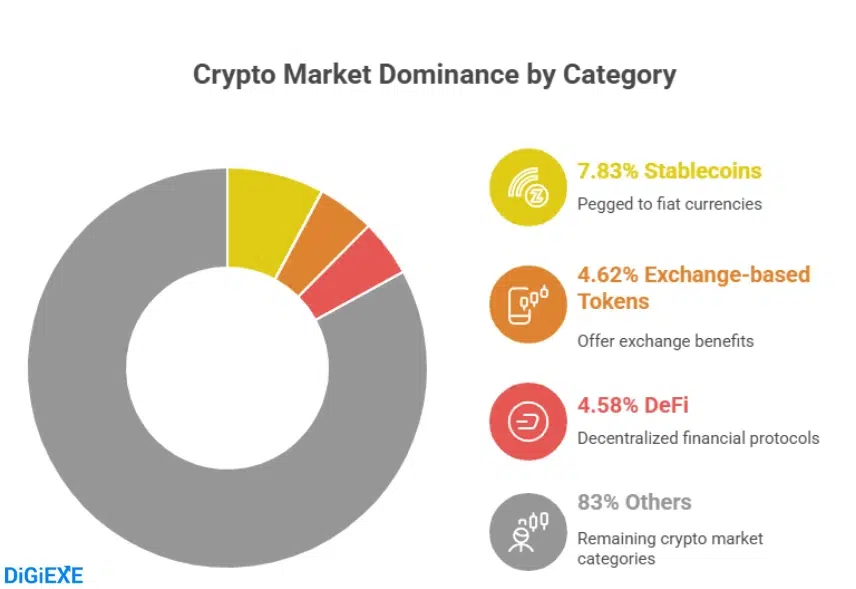

Traders who diversify into stablecoins (7.83% dominance, $279.8 billion cap) or AI tokens (2.54% share, $29.4 billion) hedge volatility while chasing 10-100x returns, and beginners who start small with $100-500 allocations learn the ropes without catastrophic losses.

This comprehensive guide merges the latest data with actionable strategies so you launch a resilient portfolio, time entries like pros, and turn market chaos into consistent wins.

The Altcoin Universe in [Year]

Altcoins – every cryptocurrency except Bitcoin – now number over 18,507 across global exchanges, up dramatically from 10,000 in 2021, reflecting an explosion of innovation and speculation.

This vast ecosystem spans 1,395 DeFi tokens worth $163.5 billion (4.44% dominance), 5,310 meme coins totaling $72.7 billion (4.21%), and 350 stablecoins holding steady at $279.8 billion (7.83%).

The combined altcoin market cap stands at $1.72 trillion in late 2025, capturing 43.7% of the $3.94 trillion total crypto pie, while Bitcoin clings to 56.3% dominance.

| Category | Number of Tokens | Market Cap (Billion USD) | Dominance % |

| Total Altcoins | 18,507 | 1,720 | 43.7 |

| DeFi | 1,395 | 163.5 | 4.44 |

| Meme Coins | 5,310 | 72.7 | 4.21 |

| Stablecoins | 350 | 279.8 | 7.83 |

| Exchange Tokens | 128 | 165.1 | 4.86 |

| Real World Assets (RWA) | 540 | 55.3 | 4.50 |

| AI Tokens | 1,189 | 29.4 | 2.54 |

Investors benefit by allocating 20-30% to stablecoins like USDT ($167 billion cap) for liquidity during dips, then rotating into high-growth sectors like RWA for 717% yearly gains.

Beginners start with $50-100 in diversified baskets via apps like Coinbase, learning without overexposure.

Also read about: Digital PR Statistics

Bitcoin Dominance at 56.3%: The Gatekeeper to Altseason Glory

Bitcoin’s grip on the market loosens to 56.3% in November 2025 – down from 65% mid-year – as capital trickles into altcoins, but full rotation awaits clearer signals.

Ethereum’s 13.7% share anchors stability, while “other altcoins” claim 30%, including volatile memes and DeFi upstarts.

The Altcoin Season Index hovers at 67/100 on CoinMarketCap, needing just 8 more top-100 tokens to outperform BTC over 90 days to hit the 75% threshold that sparks frenzy.

| Asset/Category | Market Share % | Market Cap (Billion USD) | 90-Day Outperformance vs BTC |

| Bitcoin | 56.3 | 2,220 | Baseline |

| Ethereum | 13.7 | 517.52 | +12% (leading alt) |

| Stablecoins | 7.83 | 279.8 | Stable (0%) |

| Other Altcoins | 30.0 | 1,180 | 67% of top 100 |

| Total Crypto | 100 | 3,940 | – |

Traders watch the index closely: crossing 75% historically unleashes 174% average returns for large-caps. Use it to time 10-20% portfolio shifts from BTC into ETH/SOL during dips, capturing beta without full risk.

Top Altcoins by Market Cap

Ethereum reigns supreme among altcoins with a $517.52 billion cap and $33.98 billion daily volume, processing 15.12 million transactions as the backbone for DeFi and NFTs.

XRP follows at $170.59 billion ($6.73B volume), powering cross-border payments with Ripple’s network.

Tether (USDT) stabilizes at $167 billion ($97.42B volume), while BNB ($115.47B) and Solana ($96.88B) round out the top five, blending utility with speed.

| Rank | Name (Symbol) | Market Cap (Billion USD) | 24H Trading Volume (Billion USD) | Key Utility |

| 1 | Ethereum (ETH) | 517.52 | 33.98 | Smart contracts, DeFi |

| 2 | XRP (XRP) | 170.59 | 6.73 | Payments, remittances |

| 3 | Tether (USDT) | 167.00 | 97.42 | Stablecoin peg |

| 4 | BNB (BNB) | 115.47 | 1.16 | Exchange fees, ecosystem |

| 5 | Solana (SOL) | 96.88 | 5.78 | High-speed dApps |

| 6 | USDC (USDC) | 67.81 | 13.29 | USD stablecoin |

| 7 | TRON (TRX) | 33.07 | 1.18 | Content sharing |

| 8 | Dogecoin (DOGE) | 31.95 | 3.11 | Meme, tipping |

| 9 | Cardano (ADA) | 30.75 | 2.89 | Sustainable PoS |

| 10 | Chainlink (LINK) | 16.76 | 2.29 | Oracles |

Diversify with 40% in top-5 for stability, 30% mid-caps like LINK for oracles (essential for DeFi), and 30% emerging like SUI ($12.09B) for scalability – this balanced approach yielded 150% returns in 2024’s partial rally.

Also read about: Metaverse Statistics

Trending Categories

Stablecoins anchor the altcoin world with $279.8 billion cap across 350 tokens, offering 7.83% dominance and zero-volatility havens for traders.

Exchange tokens like BNB tally $165.1 billion (4.86%), powering 128 platforms. DeFi’s 1,395 projects hit $163.5 billion (4.44%), while memes explode with 5,310 coins worth $72.7 billion (4.21%) – PEPE up 1,764% YTD.

| Category | Tokens | Market Cap (Billion USD) | Dominance % | Top Performer YTD |

| Stablecoins | 350 | 279.8 | 7.83 | USDT (+0.1%) |

| Exchange Tokens | 128 | 165.1 | 4.86 | BNB (+25%) |

| DeFi | 1,395 | 163.5 | 4.44 | UNI (+40%) |

| Memes | 5,310 | 72.7 | 4.21 | PEPE (+1,764%) |

| RWA | 540 | 55.3 | 4.50 | ONDO (+717%) |

| AI | 1,189 | 29.4 | 2.54 | FET (+513%) |

| Gaming (GameFi) | 909 | 12.6 | 2.14 | IMX (+303%) |

Allocate 20% to memes for high-risk/high-reward (e.g., $100 in PEPE could 10x), 30% DeFi for yields (5-15% APY), and 20% RWA for real-asset exposure – this mix balanced 2024’s 90% altcoin drawdowns with 200% recoveries.

Demographics and Adoption

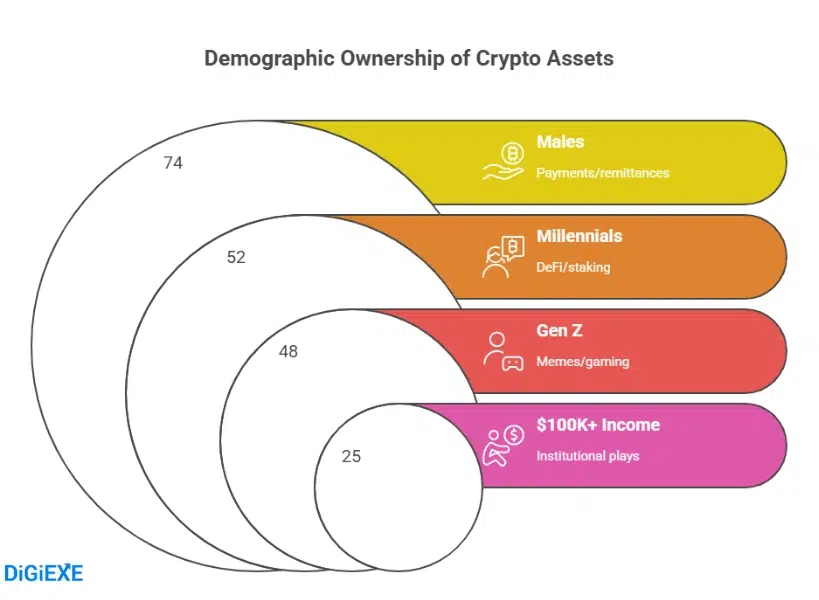

Males dominate ownership at 74% vs 26% females, but women under 40 own 31% in Asia and spend 8.5% more.

Millennials (52%) and Gen Z (48%) drive 100% of new investments, with 63% planning buys in 2025. High earners ($100K+) hold 25% of supply, averaging $111K income.

| Demographic | Ownership % | Key Trend |

| Males | 74 | Payments/remittances |

| Females | 26 | Rising 3% YoY |

| Millennials | 52 | DeFi/staking |

| Gen Z | 48 | Memes/gaming |

| $100K+ Income | 25 | Institutional plays |

Women-led communities like Women in Crypto yield 15% higher retention; young investors start with $50 ETH staking for 4.5% APY.

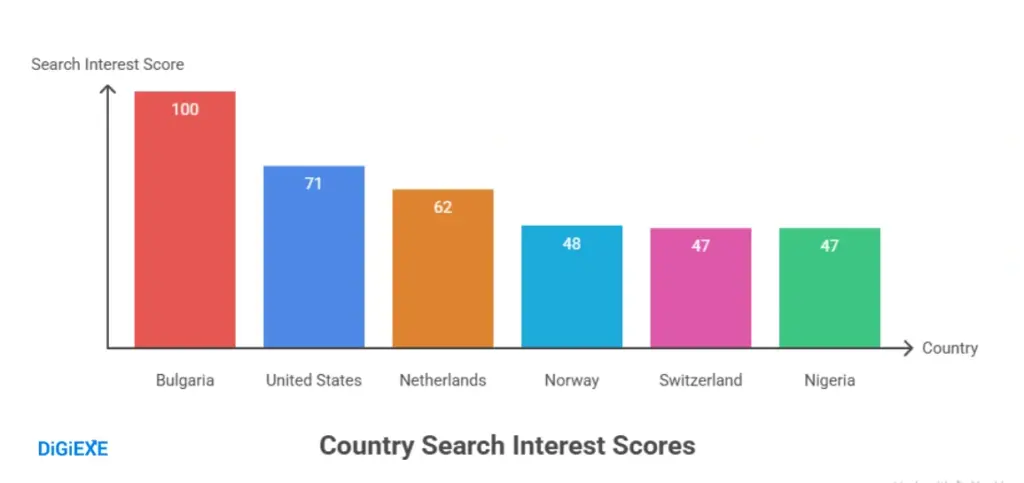

Country Spotlights: US Leads Trading, Bulgaria Tops Searches

The US claims 64% male ownership and leads volume, but Bulgaria scores 100/100 on altcoin searches. Netherlands (62), Nigeria (47), and Pakistan (37) surge on interest.

| Country | Search Interest (0-100) | Ownership Insight |

| Bulgaria | 100 | High curiosity |

| US | 71 | 15% population |

| Netherlands | 62 | DeFi focus |

| Nigeria | 47 | Remittances |

| Pakistan | 37 | Emerging adoption |

Global traders use VPNs for low-fee exchanges in Nigeria; US investors diversify via ETFs for 10-20% annual returns.

Risks and Projections: 82% Skeptical, But $1.4T Cap by Q4?

82% lack confidence due to volatility – prices swing 10-50% daily, no reversals, no insurance. Yet 63% plan buys, projecting $1.4T altcap by September. Global crypto CAGR: 14.19% to 2030.

| Risk Factor | Impact % | Mitigation Tip |

| Volatility | 90% drawdowns | Dollar-cost average $50/week |

| Irreversibility | No refunds | Use hardware wallets |

| No Insurance | Full loss potential | Stake for 5-15% yields |

| Skepticism | 82% hesitant | Educate via free courses |

Risk-averse start with $100 in USDC, earning 5% stable yields while learning.

Reddit & Quora Pulse: “Best Alts for 2025?” and “Is Season Canceled?”

Reddit’s r/CryptoMarkets debates “Alt season 2025?” with users like u/kirtash93 comparing 2021 vs now – consensus: delayed to Q4, focus SOL/LINK/TAO for AI/DeFi.

r/CryptoCurrency asks “Hope for alts?” – replies highlight ETH $20K potential if BTC hits $200K. Quora’s “Best altcoins 2024-2025?” spotlights Solana/Chainlink/Cardano for utility; “Rising in 2025?” pushes Bitcoin Minetrix for staking.

Threads warn “Alt season canceled?” but affirm Q1 2026 via looser policy.

FAQs About Altcoin Statistics [Year]

1: What percentage of the crypto market do altcoins control in late 2025?

Altcoins command 43.7% of the $3.94 trillion crypto market in late 2025, totaling $1.72 trillion across 18,507 tokens, while Bitcoin holds 56.3% dominance, but this share dips as capital rotates into Ethereum (13.7%) and emerging categories like RWA (4.50%).

2: Which altcoin categories offer the best risk-reward balance this year?

Stablecoins provide the safest entry with $279.8 billion cap and 7.83% dominance for zero-volatility holding, while DeFi (4.44%, $163.5 billion) yields 5-15% APY staking, and memes (4.21%, $72.7 billion) deliver 1,764% YTD gains like PEPE for high-risk plays.

3: How can beginners safely invest $100-500 in altcoins today?

Beginners allocate $100-500 across 40% Ethereum for stability ($517B cap), 30% Solana for speed ($96.88B), and 30% memes like PEPE for upside, using dollar-cost averaging weekly to mitigate 90% drawdowns and staking for 4.5% yields on ETH.

4: Is altseason delayed or canceled for 2025 per Reddit and Quora?

Altseason delays to Q4 2025 or Q1 2026 per Reddit r/CryptoMarkets and Quora, with users citing BTC dominance at 56.3% and Alt Index at 67/100 – focus SOL/LINK for AI/DeFi, as 63% plan buys amid 14.19% CAGR to 2030.

5: What risks do altcoins pose, and how to counter them?

Altcoins risk 90% drawdowns from volatility, irreversible transactions, and no insurance, but counter with 20% stablecoin allocation for liquidity, hardware wallets for security, and education via free courses to build confidence among 82% skeptics.

Also Read:

- Telegram Statistics

- Twitch Statistics

- Social Media Statistics

- Google Searches Statistics

- Live Streaming Statistics

CONCLUSION

Altcoin statistics 2025 clearly show that the era of blindly chasing every new token has ended, yet the opportunities have never been greater for those who invest with clarity and discipline.

With a $1.72 trillion combined market cap, 18,507 active projects, and emerging leaders in DeFi, AI, RWA, and high-performance Layer-1s, altcoins offer everything from stable 5-15% yields to explosive 10-100x upside.

Bitcoin may still dominate at 56.3%, but its steady erosion signals that capital is quietly preparing for the next great rotation.

Whether you are a beginner starting with $100 in Ethereum and stablecoins or an experienced trader positioning for the long-awaited altseason expected in Q4 2025 or Q1 2026, success now belongs to those who diversify intelligently, stake for passive income, use dollar-cost averaging through volatility, and focus on projects with real utility and growing adoption.

Master these data-driven principles today, and you position yourself not just to survive the current cycle, but to build lasting wealth in one of the most exciting and rewarding asset classes of our generation.

Source: Coingecko, CoinMarketCap