Black Friday ignites the holiday shopping frenzy each year, drawing millions of eager consumers to snag unbeatable deals on everything from electronics to apparel, and 2025 promises to elevate this tradition to new heights.

As the day after Thanksgiving—November 28 this year—Black Friday kicks off a whirlwind of discounts that extend into Cyber Week, offering savvy shoppers opportunities to stretch their budgets while retailers compete fiercely for attention.

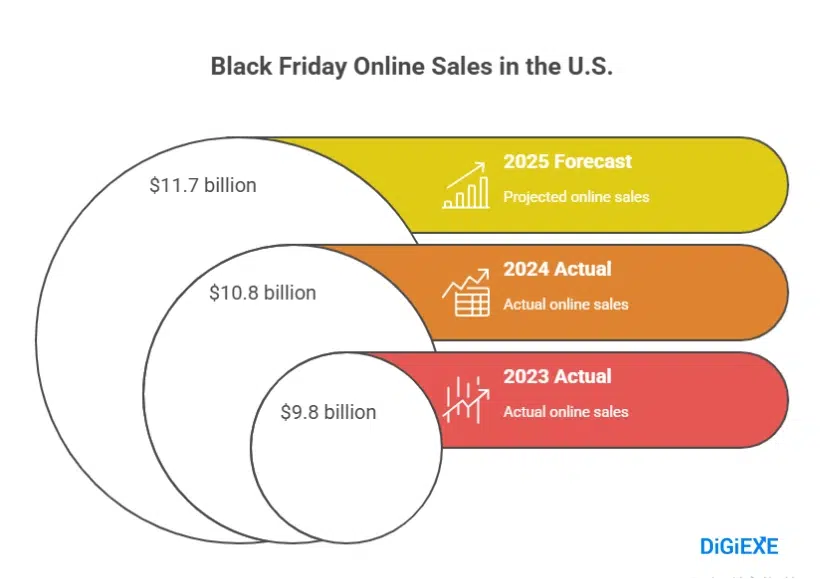

With online sales projected to hit $11.7 billion in the U.S. alone, up 8.3% from 2024’s record $10.8 billion, understanding Black Friday sales statistics 2025 empowers you to plan ahead, avoid pitfalls, and maximize your haul.

Whether you hunt for gifts, upgrade your home tech, or stock up on essentials, this guide combines historical data, fresh forecasts, and consumer insights to help you navigate the chaos profitably.

Imagine saving hundreds on a new TV or laptop without the stress of inflated “deals”—these statistics reveal how mobile shopping, AI tools, and Buy Now, Pay Later options can turn Black Friday into your personal financial win.

The event’s evolution from a post-Thanksgiving in-store rush to a global, month-long digital extravaganza reflects changing habits, with 69% of 2024 purchases happening on smartphones and early promotions starting in October.

Global spending reached $74.4 billion last year, a 5% rise, and experts forecast $80-82 billion for 2025 amid economic pressures like tariffs that could spur pre-holiday buys.

For families tightening belts, these trends mean prioritizing categories like toys (up 680% in sales) or apparel (22% average discounts), while businesses can leverage AI chatbots for 9% conversion boosts.

Recent Quora and Reddit buzz highlights skepticism over “fake” deals—users demand price tracking tools and eco-friendly options—but also excitement for extended sales windows that give you more time to compare.

By diving into Black Friday sales statistics 2025, you gain the edge to shop smarter, perhaps saving 40% on makeup or 23% on jewelry, transforming one day of frenzy into weeks of value.

Top Black Friday Sales Statistics: Key Highlights

Black Friday 2024 shattered records with $10.8 billion in U.S. online sales, a 10.2% surge from 2023, and forecasts point to $11.7 billion for 2025, driven by 55% of consumers planning to participate, up from 51%.

Globally, spending climbed to $74.4 billion last year, with Cyber Week totaling $314.9 billion—a 6% increase—and 2025 projections hover at $80-82 billion as mobile commerce claims 70% of transactions.

Shoppers numbered 87.3 million online versus 81.7 million in stores on Black Friday 2024, narrowing the gap to just 5.6 million, signaling a hybrid future where you blend app alerts with in-person try-ons for the best outcomes.

Buy Now, Pay Later (BNPL) exploded to $686.3 million on Black Friday 2024, up 8.8%, and holiday totals hit $18.2 billion (9.6% growth), with 2025 estimates at $20.2 billion—perfect for spreading costs on big-ticket items like appliances (464% sales spike).

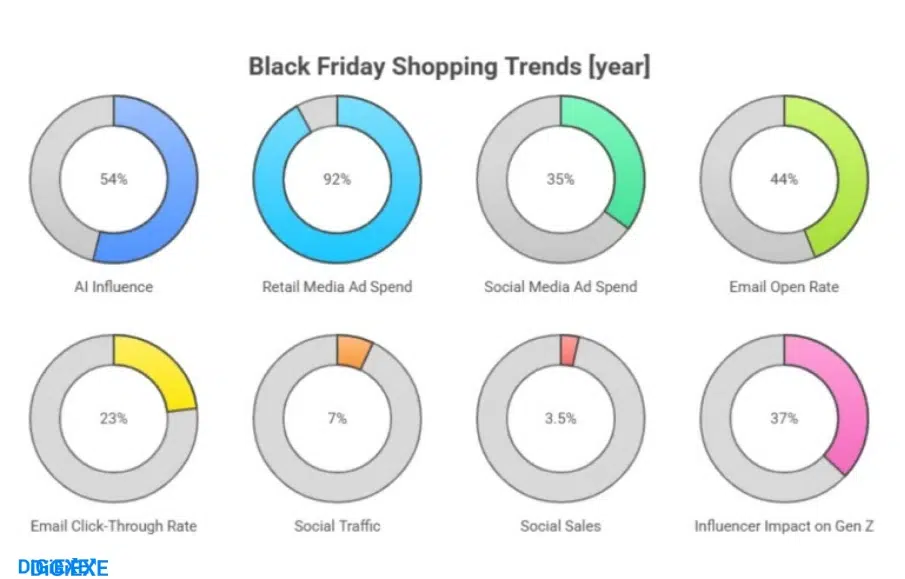

Retail giants thrived: Shopify merchants rang up $4.1 billion (22% YoY), Walmart exceeded $1.77 billion, and Target topped $500 million, while AI chatbots lifted conversions 9%.

Discounts averaged 26% across Cyber Week, peaking at 40% for makeup, rewarding early birds who start in October—60% of shoppers did last year.

On forums, Reddit’s r/blackfriday users in 2025 threads like “Is This the End of Black Friday?” debate deal authenticity, with many noting prices inflate pre-sale (e.g., “50% off after doubling costs”), urging tools like CamelCamelCamel for Amazon tracking.

Quora questions probe “How to spot real deals?” emphasizing historical lows over advertised percentages. These Black Friday sales statistics 2025 highlight your power: focus on verified drops to save 20-30% genuinely.

The table below captures key 2025 highlights versus 2024:

| Metric | 2025 Forecast | 2024 Actual | YoY Change (%) |

| U.S. Online Sales | $11.7 billion | $10.8 billion | +8.3 |

| Global Spending | $80-82 billion | $74.4 billion | +7-10 |

| Mobile Share | 70-75% | 69% | +1-6 |

| BNPL Holiday Total | $20.2 billion | $18.2 billion | +10.5 |

| Shopper Participation | 55% | 51% | +4 |

| Cyber Week Total | $330+ billion | $314.9 billion | +5 |

This overview equips you to prioritize high-growth areas like mobile for seamless, on-the-go savings.

Also read about: Scalenut Black Friday Deal

Historical Black Friday Sales Growth

Black Friday sales have ballooned since 2017’s $5 billion U.S. online figure, nearly doubling to $10.8 billion in 2024—a 96% leap fueled by e-commerce’s rise.

Projections for 2025’s $11.7 billion continue this 10-15% annual trajectory, but with nuances: Salesforce notes $17.5 billion in U.S. online (7% up), emphasizing appliances amid home-focused spending.

Mastercard reports 3.4% overall growth last year, with online soaring 14.6% versus in-store’s 0.7%, advising you to favor digital for electronics (452% global spike).

Shopify’s $4.1 billion in 2024 (22% YoY) peaked at $4.6 million per minute, with carts averaging $110.71—hinting 2025’s hybrid POS (33% up) suits multi-channel hunters.

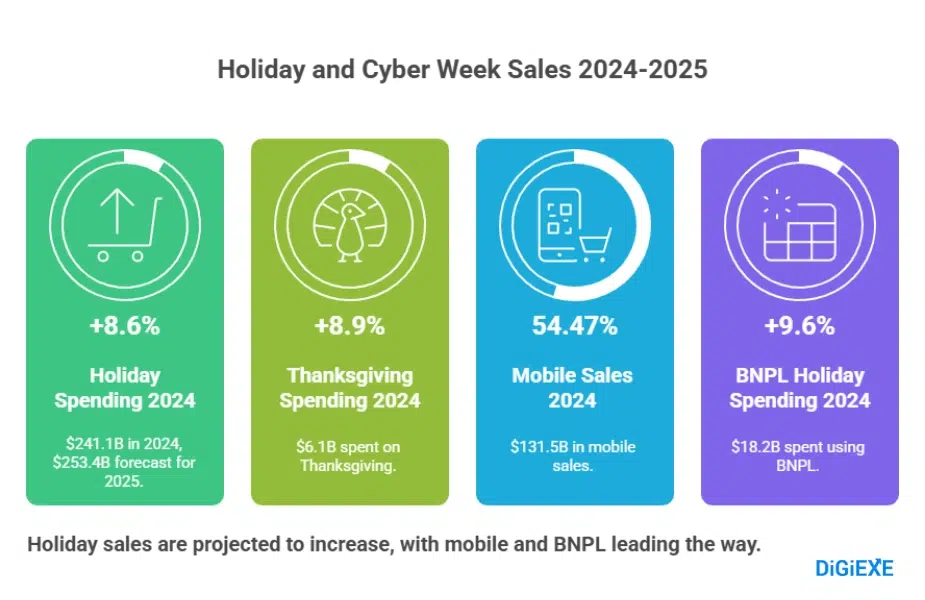

Holiday totals reached $241.1 billion in 2024 (8.6% from $222.1 billion), forecasting $253.4 billion for 2025, a 5.3% bump as 17.2% growth since 2022 adds $36.1 billion economy-wide.

For you, this history means timing matters: pre-Thanksgiving sales averaged 21% off in 2024, with 45% starting before November—use it to lock in toys at 27% reductions early.

Historical U.S. online sales table:

| Year | Sales ($ Billion) | YoY Growth (%) | Key Trend |

| 2025 | 11.7 | 8.3 | AI personalization |

| 2024 | 10.8 | 10.2 | Mobile dominance |

| 2023 | 9.8 | 7.5 | BNPL surge |

| 2022 | 9.12 | 2.2 | Post-pandemic rebound |

| 2021 | 8.92 | -1.2 | Supply chain issues |

| 2020 | 9.03 | 22.0 | E-commerce boom |

| 2019 | 7.4 | 19.4 | In-store hybrid |

| 2018 | 6.2 | 24.0 | Digital shift begins |

| 2017 | 5.0 | N/A | Baseline growth |

Sources: eMarketer

Track these patterns to anticipate 2025’s 11% Cyber Five growth, per Bain, outpacing 4% holiday average.

Also read about: Lucky Orange Black Friday Deals

Black Friday Shopper Statistics

Over 197 million Americans shopped Thanksgiving week in 2024, down slightly from 200.4 million, but 88% plan Cyber Week participation in 2025—up from 84%.

Black Friday drew 87.3 million online (vs. 81.7 million in-store), balancing channels, while Saturday flipped to 61.1 million in-person over 53.9 million digital. Cyber Monday’s 64.4 million online dwarfs 23.2 million stores, ideal for remote deal-grabbers.

Globally, 55% intend to shop Black Friday, with Gen Z (52% in UK) leading via TikTok Shop ($100M+ sales).

Hybrid habits prevail: 63% mix online-offline, boosting carts to $112.39 on apps (14% up). For benefits, join the 94% Amazon shoppers—nearly all Cyber Week participants—using wishlists for alerts.

Shopper numbers table (2024):

| Day | Online (Millions) | In-Store (Millions) | Total Shoppers (Millions) |

| Thanksgiving | 28.6 | 26.1 | 54.7 |

| Black Friday | 87.3 | 81.7 | 169.0 |

| Saturday | 53.9 | 61.1 | 115.0 |

| Sunday | 32.8 | 25.6 | 58.4 |

| Cyber Monday | 64.4 | 23.2 | 87.6 |

Source: NRF.

Reddit’s r/Frugal warns of “chaos” at Walmart (71% in-person plans), suggesting app reservations for pickups to save time and snag exclusives.

Also read about: Bluehost Black Friday Cyber Monday Deals

Worldwide Trends and Cross-Border Savings Tips

Global online Black Friday hit $74.4 billion in 2024 (5% up), with Cyber Week $314.9 billion (6%), and 2025 eyes $80+ billion as Europe surges 205% in orders. UK spending: $4.6 billion (5.2% up); Australia: 30% fashion boost. Mobile drove $220 billion worldwide, 70% of orders.

For international shoppers, this means VPNs for U.S. deals or apps like Honey for global cashback—save 10-15% on imports. Bain notes Black Friday’s 9% holiday share, highest ever, with 11% growth.

Category discounts table (2024, expected similar 2025):

| Category | Discount (%) | Sales Spike (%) | Tip for Shoppers |

| Makeup | 40 | N/A | Stock up on sets |

| Apparel | 34 | 392 | Layer for winter |

| Skincare | 33 | 530 | Bundle for value |

| Toys | 27 | 680 | Gift early |

| Electronics | 23 | 452 | Compare specs |

Quora users ask about global shipping; tools like Shipito forward U.S. deals affordably.

Holiday and Cyber Week Sales

Holiday spending totaled $241.1 billion in 2024 (8.6% up), forecasting $253.4 billion for 2025.

Thanksgiving: $6.1 billion (8.9% up); Cyber Monday: $13.3 billion record. Pre-days like Veterans’ ($3.3B, 6.5% up) signal early action.

Mobile: 54.47% of sales ($131.5B); desktop: 45.53% ($109.9B). BNPL: $18.2B holiday (9.6% up), Cyber Monday $991.2M peak.

Key days table (2024 vs. 2023):

| Day | 2024 ($B) | 2023 ($B) | Growth (%) |

| Veterans’ | 3.3 | 3.1 | 6.5 |

| Thanksgiving Eve | 4.1 | 3.9 | 5.1 |

| Thanksgiving | 6.1 | 5.6 | 8.9 |

| Black Friday | 10.8 | 9.8 | 10.2 |

| Cyber Monday | 13.3 | 12.4 | 7.3 |

Stretch wins by chaining deals—use Cyber Monday for tech after Black Friday apparel.

Also read about: OptinMonster Black Friday Cyber Monday Deal

Mobile and BNPL Trends

Mobile claimed 69% of 2024 purchases (79% BNPL), generating $131.5B holiday-wide, with apps boosting carts 14%. 2025 forecasts 70-75% share, as TikTok Shop hits $100M+.

BNPL: $686.3M Black Friday (8.8% up), $20.2B holiday forecast—75% mobile. Avoid debt by budgeting; apps like Affirm cap interest-free periods.

Reddit r/personalfinance tips: Set alerts for mobile exclusives, saving 20% extra.

Retailer Spotlights: Lessons from Walmart, Target, and Shopify

Walmart: $1.77B Black Friday 2024, steady post-day. Target: $500M+, peaking $600M. Shopify: $4.1B (22% up), $11.5B weekend (24%).

For you, shop these for reliability—Walmart for groceries (71% in-person), Target for toys.

Black Friday Discounts

Discounts averaged 26% in 2024, with apparel 34%, toys 27%. 2025: TVs 23%, furniture 18%. 57% want advance info; AI traffic up 520%.

Products table:

| Product | Discount (%) | Popularity Tip |

| Earrings | 23 | Pair with outfits |

| Rings | 22 | Timeless gifts |

| Shirts/Tops | 22 | Versatile wardrobe |

| Pants | 22 | Everyday essentials |

| Coats/Jackets | 22 | Winter prep |

| Dresses | 20 | Holiday parties |

| Necklaces | 19 | Layering trends |

| Shoes | 19 | Comfort first |

| Monitors | 17 | Home office upgrades |

| Headphones | 16 | Audio deals |

Quora: “Best categories?”—Electronics for techies.

Latest from Quora and Reddit

Quora threads in 2025 dissect “Will Black Friday deals be real?” with users citing Singles Day rivalry but affirming U.S. dominance via stats like 55% participation.

Tips: Monitor via apps, as 98% deals beat elsewhere sometimes. Reddit r/Infographics’ “End of Black Friday?” (50+ upvotes) vents on fake discounts—”prices double pre-sale”—but praises early October starts (60% shoppers).

r/blackfriday leaks ads (e.g., Academy Sports Nov 20-29), while r/ipad queries iPad deals, noting chaos avoidance via alerts. r/hometheater debates Samsung TVs: “Spring better?” but expects lows.

r/AussieFrugal favors Black Friday over Boxing for appliances, urging price tracking. r/questions fears “Broke Friday” amid bills, yet excitement for eco-delivery (50% preference). These reveal: Skepticism high, but tools and hybrids win—track for 30%+ savings.

FAQs About Black Friday Sales Statistics

1. How can shoppers use Black Friday sales statistics 2025 to spot genuine deals?

Shoppers can use price-tracking tools like CamelCamelCamel or Honey to check historical lows and aim for 20-30% off regular prices. Monitor early promotions in October, cross-reference discounts with 2024 benchmarks, and use Reddit for deal leaks to avoid inflated prices.

2. What strategies help families maximize savings on holiday gifts during Black Friday?

Focus on high-growth categories like toys (27% off) and use hybrid shopping (online + in-store). Set budgets with BNPL for interest-free payments, start shopping early with wishlists, and seek eco-gift options for better value.

3. How do mobile trends in Black Friday sales statistics 2025 benefit on-the-go shoppers?

Mobile apps power 70-75% of transactions, enabling easy shopping while on the move. Use apps for push notifications, AI recommendations, and access to exclusive deals, making it easier to save on the go without needing a desktop.

4. What role does BNPL play in Black Friday 2025, and how can users avoid debt traps?

BNPL will facilitate $20.2 billion in spending. To avoid debt traps, users should set limits on their spending and check for hidden fees, while pairing BNPL with cashback tools for additional savings.

5. What emerging trends should Black Friday 2025 shoppers watch for authentic experiences?

Shoppers should watch for extended Black Friday promotions starting in October, sustainability options like eco-delivery, and AI-driven personalization. Forums also highlight hybrid shopping and eco-friendly products as key trends for genuine deals.

Also Read:

- Most Expensive NFTs Sold Statistics

- DeepSeek AI Statistics

- iPhone Users Statistics

- Online Gaming Statistics

- Digital Marketing Statistics

Conclusion

Black Friday’s $11.7B U.S. forecast, $80B+ global, and 70% mobile surge make 2025 a savings bonanza. From BNPL’s $20.2B to 40% makeup cuts, apply stats: Start October, hybrid shop, track prices.

Forums echo authenticity—beat fakes with tools, eco-focus for loyalty. Dive in November 28; emerge with wallet intact, home upgraded.

Sources: Salesforce, Adobe, Shopify