A new entrepreneur reaches out to us each week seeking advice to start their business. Amazon business licenses are the most common question we receive.

In this post, we’ll examine marketplaces such as Amazon and its competitors. Starting an online business requires a thorough understanding of how everything should be done.

You should also find this to be an exciting time for you!

You have taken more action than most people by going out there and taking action.

It’s not necessary for people to complicate things so much. In an effort to figure out the multitude of Federal, State, and Local licenses that exist, one can get lost and run around in circles.

Here are the important points. The difference between an online business and a side hustle or hobby is the amount of money you’re making.

When you are not making money, you do not have a business. From the taxman’s point of view, you do not exist. Put your efforts into making sales first.

Do You Need An LLC To Sell On Amazon? 2026

Can I sell online without a license?

To answer this question, let’s examine the top online marketplaces:

No, in a nutshell. Selling products online, including at Amazon, does not require a business license.

Amazon doesn’t regulate most of its products because most of them aren’t federally regulated. Consumer products are generally sold online and don’t need government approval.

You do not need to register a business or have a license to sell on the following marketplaces.

- Amazon

- Shopify

- Etsy

- eBay

- Craigslist

Any of these sites allow you to sell and buy without forming a business or having a license.

As soon as you start making money, you need to make sure that all of your income is reported at tax time.

Do You Need an LLC to Sell on Amazon?

No, in a nutshell. Amazon does not require you to form an LLC. As a sole proprietor, you can begin selling immediately.

What is a Sole Proprietorship?

An unincorporated business with one owner is referred to as a sole proprietorship. It’s simply a matter of starting a business. As soon as you sell a product or service, you become a sole proprietor.

Online businesses are best run as sole proprietorships. A sole proprietorship does not have a legal separation between the owner and the business, so any liabilities such as debts or lawsuits fall on the owner personally.

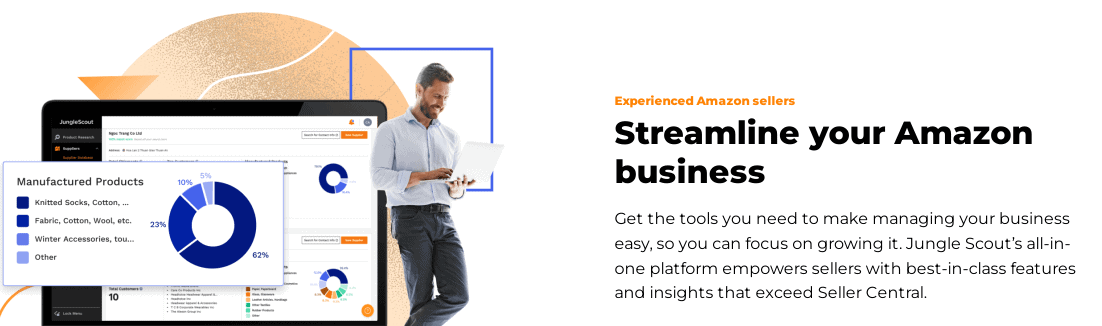

What is an LLC?

LLCs (Limited Liability Companies) are specific to the U.S., designed to protect owners from debt and other liabilities. LLCs (Limited Liability Companies) are specific to the U.S., designed to protect owners from debt and other liabilities.

It means that you won’t be liable for your business’s debts or lawsuits – the LLC will be. A sole proprietorship can only have one member, while an LLC has multiple members.

So, what is the difference?

A key difference between an LLC and a corporation is that an LLC provides you with much greater protection. LLCs are legal entities separate from their owners.

LLCs are used to run businesses – they have a bank account, they owe money, they borrow money, they sue, and they are sued. Real estate can also be purchased and sold through LLCs.

Whenever your business is sued or accrues debts, you are personally liable. When you have an LLC, your business’s creditors cannot get their hands on money or assets that you own personally, such as your home and savings.

A seller’s insurance policy can provide protection against that, but creating an LLC separates the business from you.

LLCs for single-person operations are taxed the same as sole proprietorships – you just have more protection.

It is fast and easy to form a sole proprietorship because all you have to do is start selling, but eventually, you must think about protecting your business and yourself with an LLC.

FAQs | Do You Need An LLC To Sell On Amazon?

🙆♀️ Are Amazon sellers required to have a permit?

The answer is no. It is so simple to sell on Amazon because you are operating an online business, not selling anything regulated by the government.

🙋 Can you sell on Amazon if you are not a registered business?

Selling on Amazon does not require you to be a registered business. You are not required to register an Amazon business; however, it may be necessary to register a business with your local government.

🧏♂️ Are you required to have a business license to sell online?

Online sellers don't need a business license as long as what they're selling isn't federally regulated.

Quick Links

Conclusion | Do You Need An LLC To Sell On Amazon? 2026–

I hope this post has answered any questions you might have about starting an online business. It’s easy to feel overwhelmed when starting out and think there is more to do. You need to make money for your business to succeed. Until you have income, don’t bother formally registering. Just do something.