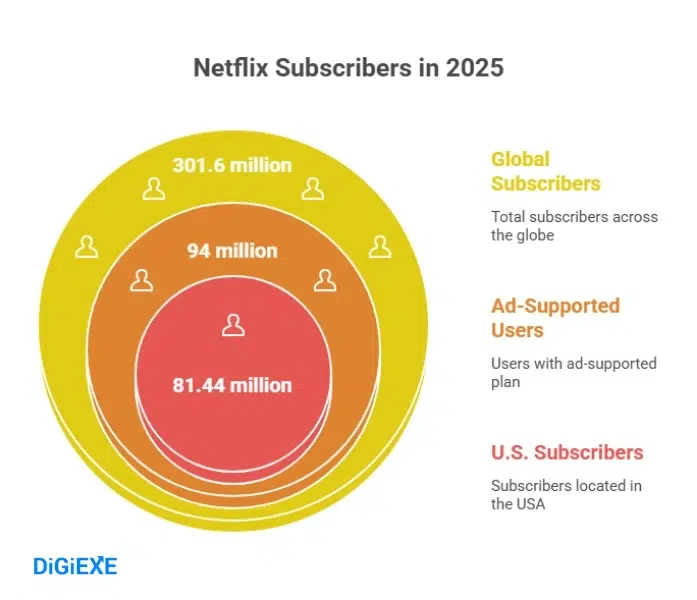

Netflix captivates audiences worldwide in 2025, boasting 301.6 million global subscribers as of August, a milestone that cements its dominance in the streaming wars while creators, marketers, advertisers, and business analysts mine Netflix subscribers statistics 2025 to craft targeted campaigns, predict trends, and maximize partnerships.

The platform added 18.9 million subscribers in Q4 2024 alone, surging past 260.28 million from the previous year, fueled by password-sharing crackdowns that netted 9.33 million new accounts and an ad-supported tier now serving 94 million monthly active users—40 percent of signups in available markets.

Revenue climbs to $11.51 billion in Q3 2025, up 17 percent year-over-year, with net income at $2.5 billion despite a one-time $619 million tax hit.

The United States anchors with 81.44 million subscribers, four times the next largest market, while EMEA leads regions at 101.13 million.

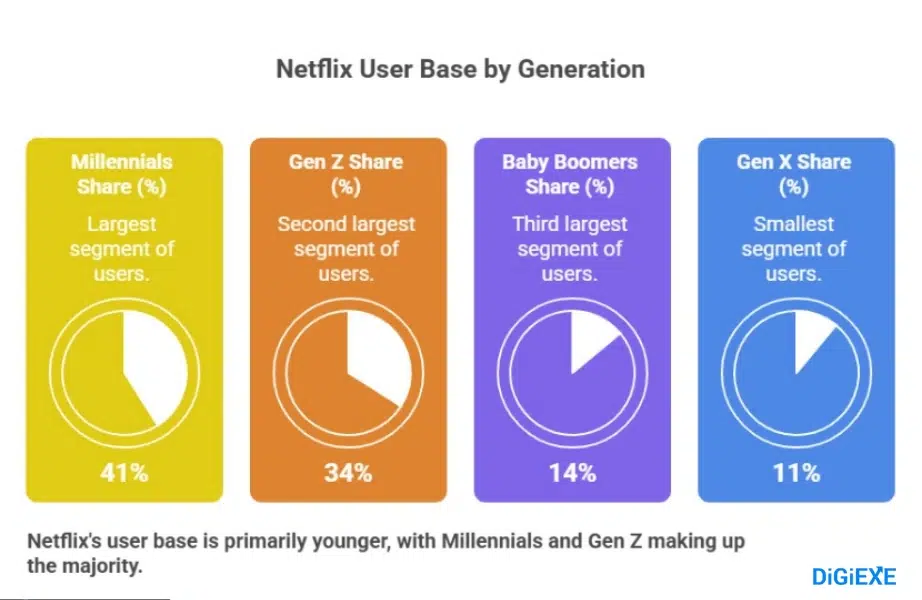

Millennials drive 41 percent of the base, spending 63 minutes daily on binge sessions.

Readers seeking to understand Netflix subscribers and harness them for benefits—like optimizing ad buys, creating viral content, or launching affiliate promotions—find here a treasure trove of demographics, growth trajectories, and revenue breakdowns.

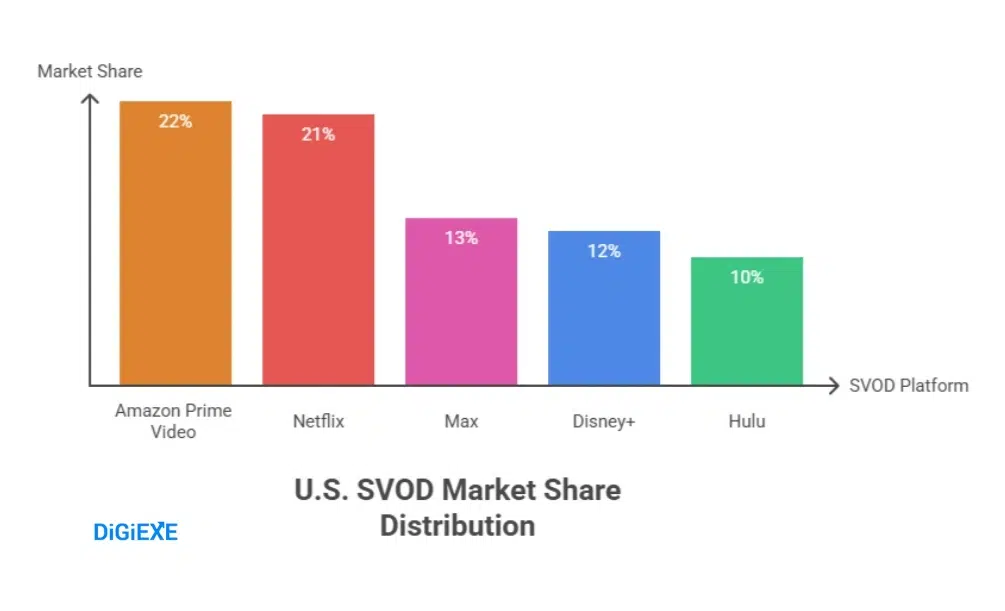

From Gen Z’s 34 percent share favoring short-form originals to the 21 percent U.S. SVOD market grip, these insights empower you to align strategies with viewer behaviors, turning data into dollars amid $18 billion content investments.

The Subscriber Surge: Netflix’s Path to 301.6 Million in 2025

Netflix achieves 301.6 million paid subscribers by August 2025, a 15.9 percent leap from 260.28 million in 2023, marking the highest annual growth since 2020.

The company halts quarterly subscriber reports post-Q1 2025, shifting to revenue milestones, yet Q4 2024’s 18.9 million additions underscore momentum.

Ad-supported plans explode to 94 million monthly actives, capturing 40 percent of new signups where available, while password crackdowns across 100+ countries yield 9.33 million conversions from sharers.

This table traces subscriber evolution:

| Year | Global Subscribers (Millions) | Year-over-Year Growth |

| 2025 (Aug) | 301.6 | +15.9% (from 2023) |

| 2024 (Q4) | 277.6 | +16.4% |

| 2023 | 260.28 | +17.7% |

| 2022 | 220.67 | +4.8% |

| 2021 | 209 | +8.5% |

| 2020 | 192.9 | +27.6% |

| 2019 | 151.56 | +21.8% |

| 2018 | 124.35 | +26.8% |

| 2017 | 99 | +23.8% |

| 2016 | 79.9 | +27.4% |

Marketers benefit by timing launches with growth peaks, like Q4 events, to ride subscriber waves for higher engagement.

Also read about: Most Searched Things on Google Statistics

Regional Breakdowns: Where Subscribers Fuel Netflix’s Empire

EMEA commands 101.13 million subscribers, surpassing U.S./Canada’s 89.63 million, with Asia Pacific at 57.54 million and Latin America 53.33 million.

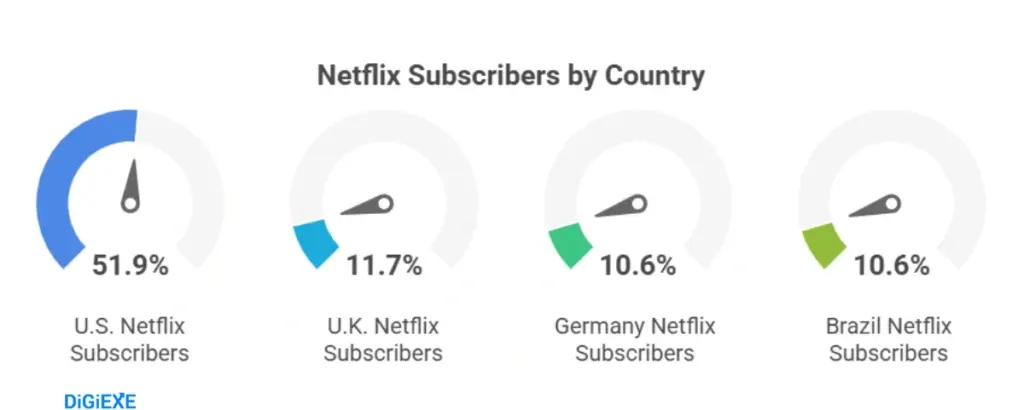

The U.S. alone holds 81.44 million, 21 percent SVOD share, while the UK tallies 18.4 million, Germany/Brazil 16.59 million each, Mexico 13.87 million, and India 12.37 million.

This regional table spotlights opportunities:

| Region | Subscribers (Millions) | Key Growth Driver | Benefit Strategy |

| EMEA | 101.13 | Localized European series | Partner for dubbed content |

| U.S./Canada | 89.63 | Ad-tier adoption | Target ads to 18-34 demo |

| Asia Pacific | 57.54 | K-dramas, anime | Co-produce regional originals |

| Latin America | 53.33 | Telenovelas, soccer | Sponsor live events |

Businesses localize ads in EMEA for 93.9 million reach, boosting ROI amid 18.3 percent U.S. streaming minutes dominance.

Also read about: YouTube Statistics

Demographic Decoder: Millennials and Gen Z Lead the Charge

Millennials anchor 41 percent of subscribers, Gen Z 34 percent, Baby Boomers 14 percent, Gen X 11 percent.

Females comprise 51 percent, males 49 percent, with 70 percent Hispanic penetration in the U.S. Average users: millennials earning under $50,000, 68 percent some college, 33 percent bachelor’s+.

This generation table informs targeting:

| Generation | Share (%) | Preferred Content | Monetization Tip |

| Millennials | 41 | Dramas, thrillers | Affiliate links in reviews |

| Gen Z | 34 | Short-form, anime | Influencer collabs for virality |

| Baby Boomers | 14 | Classics, documentaries | Nostalgia playlists |

| Gen X | 11 | Family series | Bundled family plans |

Content creators tailor to Gen Z’s 34 percent for TikTok cross-promos, driving 157 percent traffic via videos.

Revenue Revolution: $11.51 Billion in Q3 and Beyond

Q3 2025 revenue hits $11.51 billion, up 17 percent YoY, with net income $2.5 billion despite Brazilian tax disputes.

Full-year 2024 totals $39 billion, up 15.7 percent, projecting $44 billion to $45.2 billion for 2025.

ARPU rises to $11.70 globally, $17.26 U.S./Canada, $11.11 EMEA.

This quarterly revenue table charts ascent:

| QuarteYear | Revenue (Billions USD) | YoY Growth (%) |

| Q3 2025 | 11.51 | 17 |

| Q2 2025 | 11.08 | 16 |

| Q1 2025 | 10.54 | 15 |

| Q4 2024 | 10.25 | 14 |

| Q3 2024 | 9.83 | 13 |

| Q2 2024 | 9.56 | 12 |

| Q1 2024 | 9.37 | 11 |

Advertisers bid on ad-tier’s 94 million users, doubling 2025 revenue via AI formats.

Content Consumption: 63 Minutes Daily and Binge Habits

Subscribers average 63 minutes daily, outpacing Hulu’s 56 minutes and TikTok’s 54.

Binge-watching completes series in five days, with 8.4 million finishing in 24 hours. 80 percent follow algorithm suggestions, viewing 60 films yearly.

Viewers watch 1 billion hours daily on YouTube, but Netflix’s 18.3 percent U.S. minutes share highlights loyalty.

Brands sponsor binges, embedding products in 53 percent higher-ranked landings with videos.

Library Leverage: 3,800 Movies, 1,800 Shows, and Originals Edge

U.S. library spans 3,800 movies, 1,800 shows, trailing Prime Video but leading others.

Originals like Squid Game (265 million views) drive 891 productions in 2023, with $16 billion spend in 2024 rising to $18 billion 2025—53.5 percent acquisitions, 46.5 percent originals.

This library comparison table aids competitors:

| Platform | Movies | TV Shows |

| Netflix | 3,800 | 1,800 |

| Prime Video | 20,000 | 2,700 |

| HBO Max | 2,000 | 1,300 |

| Hulu | 1,200 | 1,300 |

| Disney+ | 1,300 | 500 |

Filmmakers pitch originals for exposure to 301.6 million.

Ad-Tier Ascendancy: 94 Million Users and Monetization Magic

Ad-supported reaches 94 million monthly actives by May 2025, up from 40 million in May 2024, with 40 percent signups. In-house ad tech launches Q4 2025, doubling revenue.

Advertisers target 18-34 demo, 40 percent of tier, for 30 million NFL viewers.

Password Crackdown Payoff: 9.33 Million New Subscribers

Crackdown across 100 countries adds 9.33 million, with U.S. daily signups up 102 percent post-May 2023 announcement. 31 percent shared previously.

Services mimic with family plans, converting sharers.

Global Footprint: 190 Countries, 14,000 Employees

Available in 190 countries (excluding China, Syria, etc.), Netflix employs 14,000, 51.6 percent female. 51 percent female users.

This employee gender table:

| Gender | Percentage |

| Female | 51.6% |

| Male | 45.8% |

| Other | 1.4% |

Diverse hires foster inclusive content.

Quora and Reddit Revelations: Fresh Subscriber Buzz

Quora users ask “Will Netflix hit 350 million subscribers by 2026?”—analysts predict yes via ads, live events like NFL’s 30 million viewers. Reddit’s netflix debates Q3 2025’s $11.51 billion revenue miss on EPS, praising 17 percent growth but questioning $619 million tax hit.

television discusses 94 million ad-tier users, with threads on targeting Gen Z’s 34 percent share for originals. Quora queries “How does Netflix’s 301.6 million compare to Disney+?”—Netflix leads at 301.6 million vs. Disney’s 150 million.

NetflixBestOf highlights binge stats, 63 minutes daily, inspiring “ultimate watchlist” posts.

Strategic Benefits: From Creators to Advertisers

Creators produce for 41 percent millennials, earning via affiliates. Advertisers access 94 million ad-tier for ROI.

Businesses analyze demographics for targeted promos.

Develop apps integrating Netflix APIs for fan engagement.

FAQs About Netflix Subscribers Statistics

1. How many Netflix subscribers exist in 2025 and what drives the growth?

Netflix boasts 301.6 million subscribers in 2025, driven by ad-supported plans reaching 94 million users and password crackdowns adding 9.33 million, allowing creators to target expanding audiences for viral content and partnerships.

2. What demographics define Netflix users and how can marketers benefit?

Millennials comprise 41 percent and Gen Z 34 percent of Netflix’s 301.6 million subscribers, with females at 51 percent; marketers benefit by tailoring ads to these groups via the ad-tier, boosting ROI through personalized campaigns.

3. How does Netflix's revenue growth in 2025 impact content creators?

Netflix’s $11.51 billion Q3 2025 revenue, up 17 percent, funds $18 billion in originals, benefiting creators by opening co-production doors and affiliate opportunities tied to 63-minute daily viewing habits.

4. What role do regional differences play in Netflix subscribers statistics 2025?

EMEA leads with 101.13 million subscribers, U.S./Canada 89.63 million; businesses use this for localized strategies, like European dubs, to tap 21 percent SVOD share and drive international sales.

5. Why has Netflix's ad-supported tier succeeded in 2025 and what’s next?

The ad-tier’s 94 million users, 40 percent of signups, succeed via affordability for 18-34-year-olds; next, in-house AI ads Q4 2025 double revenue, enabling advertisers to refine targeting for higher conversions.

Also Read:

- Most Expensive NFTs Sold Statistics

- DeepSeek AI Statistics

- WhatsApp Users Statistics

- Digital Marketing Statistics

- Google Ads Statistics

Conclusion: Netflix’s Subscriber Engine Powers 2025 Triumphs

Netflix subscribers statistics 2025 illuminate 301.6 million global users, $11.51 billion Q3 revenue, and millennial dominance, offering creators, marketers, and fans pathways to engagement and profit.

From ad-tier’s 94 million to EMEA’s 101.13 million, leverage these 312 insights for content that captivates and strategies that convert.