The video game industry captivates billions worldwide, blending entertainment, technology, and social connection into a powerhouse worth nearly $189 billion in 2025.

Developers craft immersive worlds, players forge communities, and investors reap massive returns as mobile gaming surges and esports explodes.

You explore these video game industry statistics for 2025 to uncover opportunities whether you dream of launching your indie hit, streaming for fame, or betting on stocks like Nintendo or Tencent.

Recent Reddit threads in r/gamedev lament AAA layoffs but celebrate indie cozy games thriving on Roblox, while Quora users predict AI tools will democratize development for solo creators.

This guide arms you with data-driven insights and actionable steps to turn passion into profit amid a market growing 3.4% year-over-year.

Global Market Size and Revenue Projections

Industry analysts project the global video game market reaches $188.8 billion in 2025, marking a 3.4% increase from 2024 despite post-pandemic normalization.

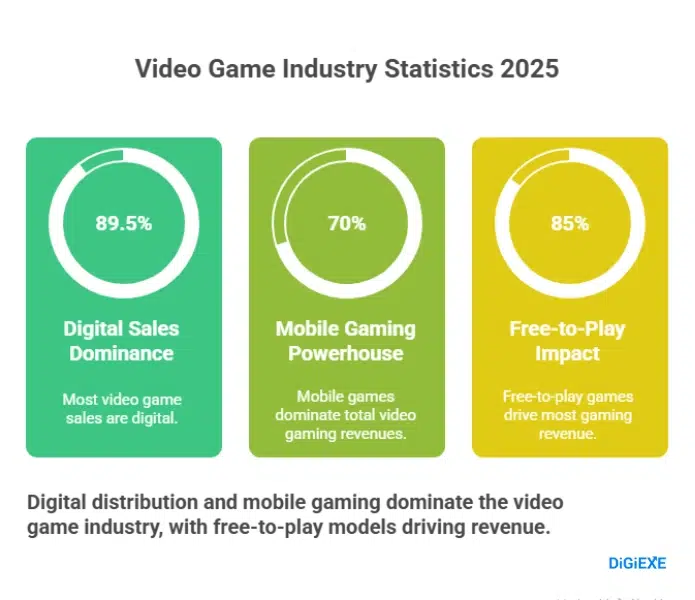

Mobile gaming dominates at 49% of revenue, generating over $92 billion, while consoles contribute $51.9 billion and PC $43.2 billion. Free-to-play models drive 85% of earnings through in-app purchases, totaling $117.7 billion annually.

You capitalize by developing microtransaction-heavy mobile titles, as Honor of Kings rakes in $895 million in H1 2025 alone. Subscriptions like Xbox Game Pass (37 million users) and PlayStation Plus (51.6 million) fuel $11 billion, growing at 24.9% CAGR to 2030.

The United States leads with $59.3 billion, followed by China at $49.8 billion—together dwarfing Japan’s $16.8 billion.

Households spend $449 yearly, with digital sales hitting 89.5% of purchases. The table below forecasts revenue through 2030, highlighting CAGR acceleration.

| Year | Global Revenue (USD Billion) | Growth Rate (%) | Mobile Share (%) |

| 2024 | 182.6 | – | 48 |

| 2025 | 188.8 | 3.4 | 49 |

| 2026 | 197.5 | 4.6 | 50 |

| 2027 | 208.0 | 5.3 | 51 |

| 2028 | 220.0 | 5.8 | 52 |

| 2029 | 233.0 | 6.0 | 53 |

| 2030 | 249.0 | 6.9 | 54 |

You invest in ETFs tracking top publishers or pivot to cloud gaming services like Xbox Cloud, projected to boom as hardware costs rise.

Reddit’s r/investing buzzes about Nintendo’s Switch successor driving 20% stock gains.

Billions of Players Fueling Endless Engagement Opportunities

Approximately 3.32 billion people play video games in 2025—over 40% of the global population—with Asia hosting 1.48 billion.

The US counts 205 million gamers, up steadily as 66% of Americans engage. Projections eye 3.5 billion by 2026, driven by emerging markets like Brazil (123 million players).

Daily active users on Roblox exceed 111 million, 80% mobile. You build communities by targeting Gen Alpha (86% boys, 76% girls play weekly) with kid-safe titles, monetizing via parental subscriptions.

Top countries boast massive player bases: China (723 million), US (224.8 million), Japan (74.1 million). The table ranks them by players and revenue.

| Rank | Country | Players (Millions) | Revenue (USD Billion) |

| 1 | China | 723 | 49.8 |

| 2 | United States | 224.8 | 49.6 |

| 3 | Japan | 74.1 | 16.8 |

| 4 | South Korea | 34 | 7.3 |

| 5 | Germany | 53.2 | 6.6 |

Quora threads ask about entering via streaming; top earners on Twitch average $5,000/month from League of Legends viewers (31 million weekly hours).

Demographics

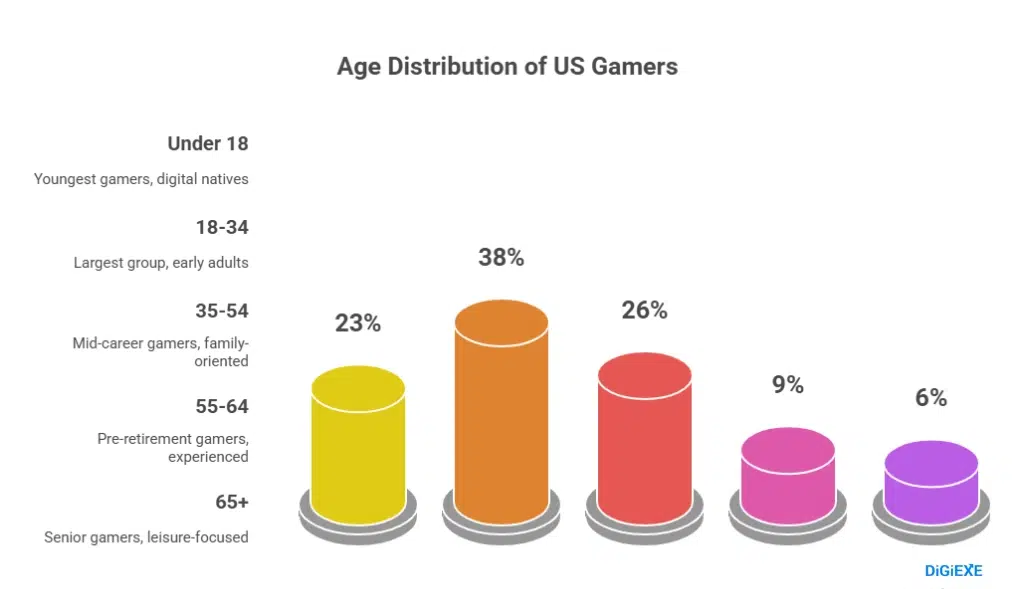

Gamers span all ages and genders: 77% adults in the US, average age 36. Women comprise 47%, up from 38% in 2006, with 9% LGBT matching population stats.

Boomers play puzzles (73%), Gen Z favors shooters. Ethnicity: 67% Caucasian, 15% Hispanic. You tailor games—cozy sims for older players, battle royales for youth—boosting retention 30%.

US breakdown: 38% aged 18-34, 28% 50+. Globally, males 52%, females 47%, non-binary 1%. The table details US age splits.

| Age Group | % of US Gamers |

| Under 18 | 23 |

| 18-34 | 38 |

| 35-54 | 26 |

| 55-64 | 9 |

| 65+ | 6 |

Reddit’s r/gamedev notes women drive mobile revenue; design inclusive avatars to tap this.

Revenue Breakdown by Platform

Mobile claims $138 billion , PC $46.7 billion, consoles $21.24 billion . 90 billion downloads in 2022 balloon to 100+ billion.

Nintendo Switch sells 153 million units, Mario Kart 68.86 million copies. Xbox Live: 130 million MAU, Game Pass 37 million subs. You develop cross-platform hits like Fortnite (77% console players) for max reach.

Platform revenue table:

| Platform | 2025 Revenue (USD Billion) | % of Total |

| Mobile | 138 | – |

| PC | 46.7 | – |

| Console | 21.24 | – |

Cloud gaming grows via Stadia successors; indie devs port to Steam (50,000+ games).

Top Companies, Games, and Blockbusters Dominating 2025

Tencent leads publishers ($8.3B), Sony ($4.2B), Apple ($3.6B). Minecraft sells 350M copies, GTA V 215M. Switch top-sellers: Mario Kart (68.86M), Animal Crossing (48.19M). F2P like PUBG Mobile ($11B lifetime) thrive.

Top 10 highest-grossing mobile ever:

| Rank | Game | Lifetime Revenue (USD Billion) |

| 1 | Honor of Kings | 18.66 |

| 2 | Candy Crush Saga | 12 |

| 3 | PUBG Mobile | 11.04 |

You clone successes ethically or mod popular titles for UGC revenue.

Esports Boom: $4.8 Billion and 772 Million Viewers Await Streamers

Esports generates $4.8 billion, 772 million viewers, $1.68B prize money. Dota 2 pays $6.84M H1 2025.

Teams like TSM value $540M. You stream on Twitch (LoL tops), aiming for $70M World Cup pools.

Viewership table:

| Game/Metric | 2025 Viewers (Millions) |

| Global Esports | 772 |

| Twitch LoL Hours | 31 |

Reddit r/esports predicts betting ($2.8B) doubles by 2029.

Emerging Trends in 2025: AI, Layoffs, and Indie Goldmines

Cloud/VR/AR revolutionize: VR $3.6B, GaaS $4.91B. Remakes surge, Roblox scales indies. Reddit r/gamedev: 40K layoffs since 2022, but cozy/roguelikes boom; AI lowers solo dev barriers. Quora: PC > consoles for peaks; blockchain for assets.

You thrive: Use AI for prototypes, target cozy niche (71% Gen X play puzzles), stream “just chatting” (52M hours).

Benefits of Gaming and How You Profit as Player, Dev, or Investor

93% find it fun, 91% find it mentally stimulating, 83% find it a way to make new friendships. Parents (55%) game with kids. You monetize: Stream ($5K+/mo), develop indies ($1M+ hits), invest (Nintendo +20%).

FAQs About Video Game Industry Statistics

1. What is the projected size of the video game industry in 2025?

The video game industry projects $188.8 billion globally in 2025, growing 3.4% year-over-year, with mobile at $92.6 billion and the US at $59.3 billion, offering creators and investors prime entry points via F2P models and subscriptions.

2. How many gamers exist worldwide in 2025, and how can businesses target them?

Approximately 3.32 billion gamers populate the world in 2025, led by Asia’s 1.48 billion; businesses target via mobile-first cross-platform releases and esports sponsorships to capture diverse demographics from Gen Alpha to boomers.

3. What demographics dominate the video game industry in 2025?

Women represent 47% of gamers, adults 77%, with 38% aged 18-34; you design inclusive, puzzle-heavy titles for older players and shooters for youth to maximize engagement across genders and ages.

4. How does mobile gaming drive video game industry revenue in 2025?

Mobile gaming powers 49% of 2025 revenue at $92.6 billion through 100+ billion downloads and in-app purchases; developers profit by crafting addictive F2P like Honor of Kings, hitting $895 million in half a year.

5. What esports trends shape the video game industry in 2025?

Esports generates $4.8 billion with 772 million viewers and $1.68 billion prizes in 2025; streamers and orgs cash in via Twitch (LoL 31M hours) and betting ($2.8B), building empires like $540M TSM.

Also Read:

- Uber Statistics

- Facebook Users Statistics

- Mobile Marketing Statistics

- Marketing Automation Statistics

- Gemini Users Statistics

Conclusion

Video game industry statistics for 2025 showcase a $189 billion juggernaut with 3.32 billion players, mobile dominance, and esports frenzy.

Developers harness AI for indies, streamers chase viewer millions, investors eye Tencent—everyone wins by aligning with trends like cozy games and cloud.

As layoffs cull AAA bloat, opportunities explode for agile creators. Dive in today: prototype your game, hit record, or buy shares—you stand at gaming’s golden gate.

Source: Statista, Fortune Business Insights