Tesla continues to lead the charge in transforming the automotive landscape with its innovative electric vehicles and cutting-edge technology.

As we delve into 2025, the company has achieved remarkable milestones, including record-breaking deliveries in certain quarters despite market challenges.

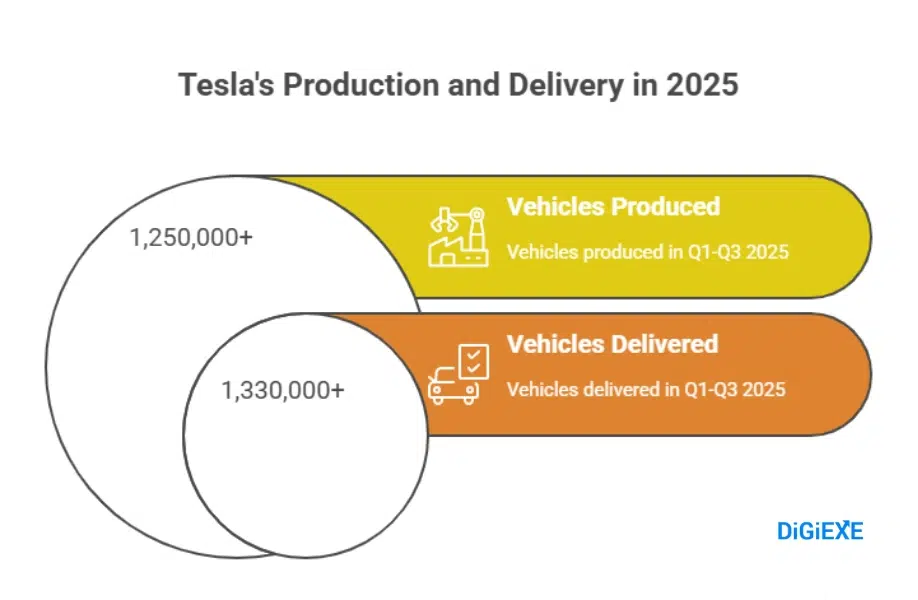

Tesla produced over 1.25 million vehicles in the first three quarters of 2025 and delivered approximately 1.33 million units during the same period.

The company’s revenue has surged, reaching new heights, driven by energy storage and autonomous driving initiatives.

With a market capitalization exceeding $1.3 trillion as of November 2025, Tesla holds a prominent position in the global economy.

Elon Musk owns about 21% of the company, guiding its vision from headquarters in Austin, Texas.

In the following sections, we explore detailed statistics on Tesla’s production, sales, revenue, and more, and highlight how individuals can leverage these insights to benefit personally, such as investing in sustainable transport or adopting energy-efficient solutions.

Tesla Statistics [Year]: At a Glance

Tesla has solidified its dominance in the electric vehicle sector by pushing boundaries in innovation and efficiency.

The company launched its first vehicle in 2008 and has since expanded to include models like the Cybertruck and upcoming robotaxi services.

Tesla generated a total revenue of approximately $82 billion in the first three quarters of 2025, reflecting strong growth in automotive and energy segments.

The current market value stands at around $1.39 trillion, making it one of the world’s most valuable companies.

Tesla commands about 15% of the global electric vehicle market share in 2025, down slightly due to rising competition but still leading in key regions.

The company operates over 60,000 superchargers worldwide, with more than 6,500 stations facilitating seamless travel.

Tesla’s Autopilot system has logged billions of miles but faced scrutiny with over 800 reported crashes since 2019. Here is a table summarizing key Tesla statistics for 2025:

| Statistic | Value |

| Vehicles Produced (Q1-Q3 2025) | Over 1.25 million |

| Vehicles Delivered (Q1-Q3 2025) | Approximately 1.33 million |

| Total Revenue (Q1-Q3 2025) | $82 billion |

| Market Capitalization (November 2025) | $1.39 trillion |

| Global EV Market Share | 15% |

| Superchargers Worldwide | Over 60,000 |

| Employees | 125,665 |

| Autopilot Crashes Since 2019 | 800+ |

These figures demonstrate Tesla’s resilience and growth potential, offering opportunities for consumers to invest in vehicles that reduce long-term costs through lower fuel and maintenance expenses.

About Tesla Inc.

Tesla Inc. pioneers sustainable energy solutions, focusing on electric vehicles, battery storage, and solar products.

The company launched in 2003 under founders Martin Eberhard and Marc Tarpenning, with Elon Musk joining as chairman in 2004 and later becoming CEO.

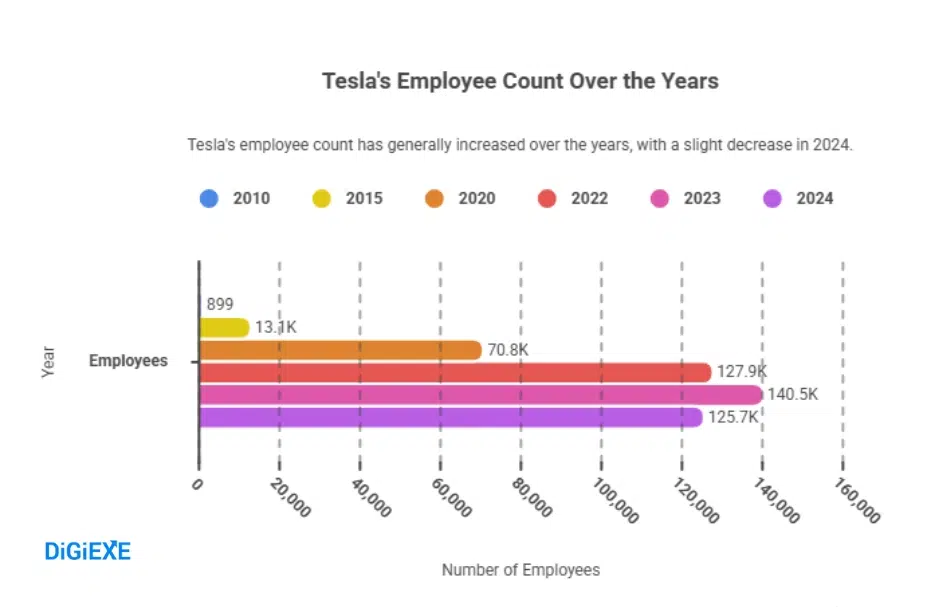

Musk now owns 21% of Tesla, steering its ambitious goals from the Austin, Texas headquarters. Tesla employs 125,665 people worldwide, a slight decrease from 140,473 in 2023 due to strategic optimizations.

The company has sold over 7.95 million vehicles to date, revolutionizing transportation with models like the Model 3, which became the first EV to surpass 1 million units sold.

Tesla’s innovations extend beyond cars, including the Powerwall for home energy storage, which helps users save on electricity bills by storing solar power.

Individuals benefit from owning Tesla products by lowering their carbon footprint and enjoying tax incentives for EV purchases in many regions.

For instance, buyers can utilize federal tax credits, potentially saving thousands on a new Model Y, while integrating solar panels reduces household energy costs by up to 70% over time.

Tesla Inc. Production Statistics

Tesla ramps up production to meet surging demand for electric vehicles amid global shifts toward sustainability. The company produced 362,000 vehicles in the first quarter of 2025, marking a significant output despite supply chain hurdles.

Production increased in the second quarter, reaching around 444,000 units, as new factories in Berlin and Shanghai optimized operations.

By the third quarter, Tesla produced over 447,000 vehicles, showcasing efficiency gains from advanced manufacturing techniques.

This represents a year-over-year growth, with total production for the first nine months exceeding 1.25 million units.

Individuals can capitalize on this by considering Tesla as a reliable supplier for fleet vehicles in businesses, reducing operational costs through durable, low-maintenance EVs.

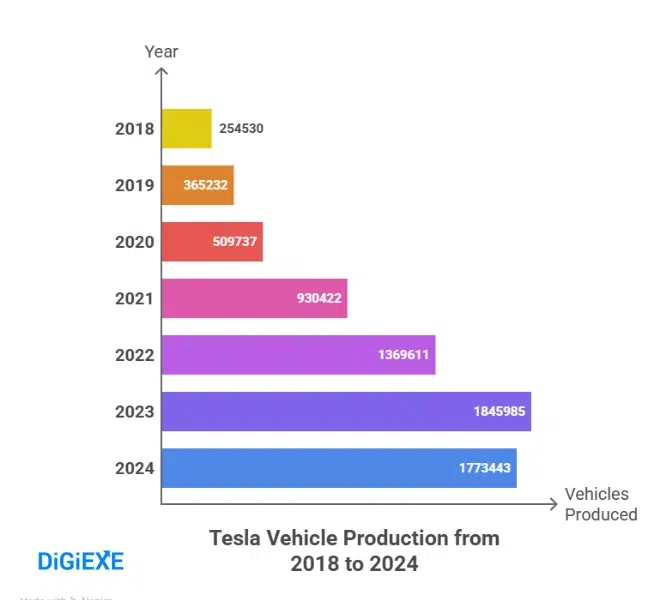

Here is a table detailing Tesla’s vehicle production over recent years, including 2025 updates:

| Year | Number of Vehicles Produced |

| 2021 | 930,422 |

| 2022 | 1,369,611 |

| 2023 | 1,845,985 |

| 2024 | 1,773,443 |

| Q1 2025 | 362,000 |

| Q2 2025 | 444,000 |

| Q3 2025 | 447,450 |

These numbers highlight Tesla’s scaling capabilities, allowing consumers to anticipate faster delivery times for orders placed in 2025.

Tesla Sales and Deliveries Statistics

Tesla drives sales growth by introducing affordable models and expanding into new markets.

The company delivered 336,681 vehicles in the first quarter of 2025, reflecting a seasonal dip but strong performance in key segments like the Model Y.

Deliveries climbed to 384,000 in the second quarter, a 14.29% increase year-over-year, fueled by demand in Europe and Asia.

The third quarter saw record deliveries of 497,099 units, surpassing expectations due to end-of-quarter promotions and tax credit incentives.

Overall, Tesla has delivered over 1.33 million vehicles in the first three quarters of 2025, positioning it as the second-largest EV seller globally after BYD.

Consumers benefit by purchasing during these high-delivery periods, often securing better deals or faster shipping.

For example, business owners can use Tesla’s commercial vehicles to cut fuel costs by 50% compared to gas-powered alternatives. Here is a table showing Tesla’s annual and quarterly deliveries:

| Year/Quarter | Total Deliveries | Key Models Contributing |

| 2021 | 936,222 | Model 3/Y, Model X/S |

| 2022 | 1,313,851 | Model 3/Y, Model X/S |

| 2023 | 1,808,581 | Model 3/Y, Model X/S |

| 2024 | 1,789,226 | Model 3/Y, Cybertruck |

| Q1 2025 | 336,681 | Model Y leading |

| Q2 2025 | 384,000 | Model 3/Y dominant |

| Q3 2025 | 497,099 | All models, including Cybertruck |

Tesla’s sales by country reveal strong U.S. performance, with over 232,400 units sold in the first five months of 2025, while China followed with 219,056.

Users on platforms like Reddit report satisfaction with delivery processes, noting quick resolutions to minor issues through Tesla’s app-based service.

Tesla Revenue and Net Income Statistics

Tesla generates substantial revenue through diversified streams, including automotive sales and energy products.

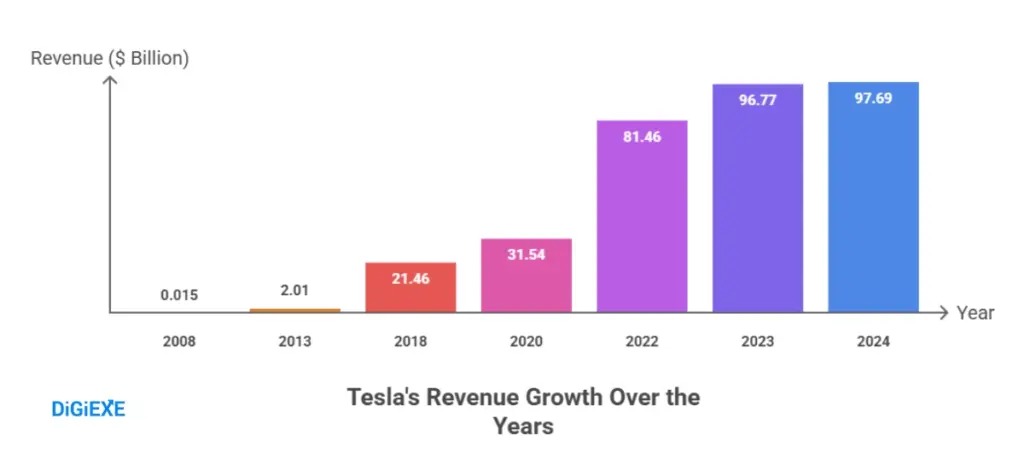

The company reported $96.77 billion in revenue for 2023, climbing to $97.69 billion in 2024, and has already achieved $82 billion in the first three quarters of 2025.

Third-quarter 2025 revenue alone reached $28.1 billion, a 12% increase year-over-year, driven by energy storage deployments of 12.5 GWh.

Net income for 2023 stood at $14.99 billion, with ongoing profitability in 2025 supported by cost efficiencies.

Individuals can benefit by investing in Tesla stock, which has shown volatility but long-term growth, or by adopting Tesla’s solar solutions to offset home energy expenses.

Here is a table outlining Tesla’s revenue growth:

| Year | Revenue (in billions) |

| 2020 | $31.54 |

| 2021 | $53.82 |

| 2022 | $81.46 |

| 2023 | $96.77 |

| 2024 | $97.69 |

| Q1-Q3 2025 | $82 |

Net income trends upward, with $1.4 billion in GAAP net income for Q3 2025, enabling reinvestment in innovations like robotaxis.

Tesla Market Capitalization and Market Share Statistics

Tesla commands a formidable market presence, with its capitalization reaching $1.39 trillion as of November 25, 2025.

This value increased by 35.92% over the past year, reflecting investor confidence in autonomous driving advancements.

The stock price closed at $419.40 on November 25, 2025, after fluctuating throughout the year.

Tesla holds a 15% share of the global EV market in Q3 2025, facing competition from BYD at 18%. In the U.S., Tesla’s EV market share dipped to 50% but remains dominant.

Investors benefit by holding Tesla shares for potential appreciation, as seen in the 95.56% market cap growth in 2023.

Here is a table of Tesla’s market cap over years:

| Year | Market Cap (in trillions) |

| 2021 | $1.061 |

| 2022 | $0.389 |

| 2023 | $0.761 |

| 2024 | $0.810 |

| 2025 (November) | $1.39 |

This growth underscores opportunities for portfolio diversification in green tech.

Tesla Superchargers Statistics

Tesla expands its charging infrastructure to support widespread EV adoption. The company operates over 60,000 superchargers worldwide as of September 2025, with 7,702 stations across 55 countries.

The U.S. hosts the most at 2,798, followed by China with 2,366. Tesla recently completed its largest station with 168 stalls, enhancing reliability for long trips.

Charging costs average $15.52 for a full charge, cheaper than gas equivalents. Users on Quora frequently ask about charging convenience, noting it saves time and money for daily commutes.

Here is a table of supercharger growth:

| Year | Superchargers | Stations |

| 2023 | 50,000 | 5,500 |

| 2024 | 55,000+ | 6,766 |

| 2025 (September) | 60,000+ | 7,702 |

Owners benefit by accessing this network for free or discounted rates with certain models, reducing travel expenses.

Tesla Autopilot and Safety Statistics

Tesla enhances safety through its Autopilot system, which reduces accident rates by 50% according to studies. However, the system has been involved in over 800 crashes since 2019, with 17 fatalities.

In 2025, Tesla records one crash every 4.85 million miles on Autopilot, compared to 1.40 million without. Recent updates include B-pillar camera improvements and dashcam enhancements in the spring release.

Reddit users discuss hopes for the 2025 holiday update, such as better navigation and Grok AI integration.

Drivers benefit by using these features for safer, hands-free commuting, potentially lowering insurance premiums.

Here is a table of Autopilot crash data:

| Quarter | Miles per Accident (Autopilot) | Miles per Accident (Without) |

| Q4 2022 | 4.85 million | 1.40 million |

| Q3 2025 | 6.50 million (estimated) | 1.50 million |

These advancements position Tesla as a leader in autonomous tech.

Tesla Employees Statistics

Tesla employs a talented workforce to fuel its innovations. The company has 125,665 employees as of 2025, down from 140,473 in 2023 due to efficiency drives.

Median compensation for software engineers reaches $198,000, attracting top talent. Employees contribute to breakthroughs like the robotaxi fleet, set to double in Austin by December 2025.

Potential hires benefit from competitive salaries and stock options, while consumers gain from improved product quality. Here is a table of employee growth:

| Year | Number of Employees |

| 2021 | 99,290 |

| 2022 | 127,855 |

| 2023 | 140,473 |

| 2024 | 125,665 |

| 2025 | 125,665 |

This stable workforce ensures reliable support for owners.

Other Tesla Statistics

Tesla innovates beyond vehicles, with the Model 3 and Y achieving 97% drive system efficiency. The Model S offers the longest range at over 400 miles.

In 2025, Tesla ranks as the 12th biggest company globally. Average salaries stand at $134,000 annually. New developments include the summer update 2025.6, adding valet notifications for chargers.

Quora users question maintenance, noting minimal issues like tire rotations every 6,000 miles. Reddit discussions highlight satisfaction with updates like speed limit recognition improvements.

Owners benefit by reselling vehicles at high values, often retaining 70% of purchase price after three years.

How Readers Can Benefit from Tesla in 2025

Readers seeking to learn about Tesla discover ways to integrate its products for personal gain. Purchasing a Tesla vehicle cuts fuel costs by 80% compared to gas-powered cars, and home charging with a Powerwall further reduces bills.

Businesses adopt Tesla fleets for tax deductions and eco-friendly branding. Investors track stock trends, like the November 2025 price of $425.177, for portfolio growth.

Quora queries reveal concerns over cold weather performance, but updates in 2025 improve battery efficiency by 10%. Reddit users share tips on using FSD for stress-free, time-saving drives.

By owning Tesla solar panels, households generate excess energy for credits, turning homes into mini power plants.

FAQs About Tesla Statistics

1. What are the main benefits of owning a Tesla in 2025?

Owning a Tesla in 2025 provides significant savings on fuel and maintenance, access to advanced features like Full Self-Driving, and environmental benefits through zero emissions, making it an ideal choice for daily commuting and long trips.

2. How has Tesla's production changed in 2025 compared to previous years?

Tesla’s production in 2025 has shown steady growth in quarterly outputs, reaching over 447,000 vehicles in Q3, which reflects improved manufacturing efficiencies and helps meet rising demand for models like the Cybertruck.

3. What is the current market share of Tesla in the EV industry?

Tesla holds approximately 15% of the global electric vehicle market share in 2025, positioning it as a leader despite increased competition from companies like BYD, and allowing consumers to choose from reliable, high-performance options.

4. How can I benefit financially from Tesla's supercharger network?

Tesla’s supercharger network, with over 60,000 chargers worldwide, enables cost-effective travel at an average of $15.52 per full charge, which saves money compared to gasoline and supports road trips without range anxiety.

5. What new features did Tesla introduce in its 2025 software updates?

Tesla’s 2025 software updates, including the spring and summer releases, added enhancements like B-pillar camera improvements, better dashcam viewing, and valet notifications for chargers, enhancing user safety and convenience.

Also Read:

- TikTok Users Statistics

- Facebook Users Statistics

- Mobile Marketing Statistics

- Link Building Statistics

- Personalization Statistics

Conclusion

Tesla’s statistics in 2025 paint a picture of a company navigating challenges while driving innovation forward.

The firm has delivered over 1.33 million vehicles in the first three quarters, generated $82 billion in revenue, and expanded its supercharger network to support global adoption.

Despite a projected 7% sales decline for the year due to competition, Tesla maintains a $1.39 trillion market cap and leads in autonomous tech with robotaxi expansions.

These achievements empower individuals to embrace sustainable living, reduce costs, and invest wisely. As Tesla evolves, it offers endless opportunities for a greener, more efficient future.

Source: Statista, Investing.com