Are you looking for an affordable and secure way to send money across borders? Two popular options are Wise (previously Transferwise) vs Payoneer.

Both provide banking services that allow individuals to receive payments online quickly and easily, but which one is the right choice for your needs?

In this blog post, we’ll explore the similarities, differences, and advantages of each company so you can decide which one is best suited to meet your individual needs.

Transferwise (Wise) Vs Payoneer Comparison: Overview

Payoneer Overview

Payoneer was founded in 2005 and also is based in New york city.

The firm aims to facilitate global transfers and cross-border payments to businesses and also to offer reliable service to individuals all over the world. I have actually been making use of Payoneer for a long period of time now.

An enviable collection of costs and multinational firms make use of Payoneer as their common payment alternatives solution, consisting of Amazon, Google, as well as Airbnb.

A firm can deposit into a Payoneer account in their own country and also the recipient can receive payments in your area with a Payoneer MasterCard or have it moved straight to their savings account.

There will certainly be one on the house for receiving cash into a Payoneer account.

TransferWise (Now Wise) Overview

Transferwise (Wise), a peer cash transfer service established in 2011, was among the most interesting brand-new innovation business at the time of its launch.

The Estonian Transferwise owners were annoyed at shedding a lot of cash when sending out money abroad and also decided to take the matter into their very own hands.

The concept of removing international financial institution charges in the world has actually permitted them to transfer greater than ₤ 3 billion of their clients’ money given that their beginning and also praise them on the simplicity of their service version and it has a much better transfer rate than other platforms.

The length of time does a transfer take? (Inspect Comparison Transferwise Vs Payoneer Here).

Initially, you must finish the total up to be transferred. As a bonus, you will then see the expected time of arrival of the amount and a few even more details.

If you select the money you desire to move, Transferwise will display the prices from the beginning as well as subtract them instantly before conversion.

Later on, mostly the middle market margin without profit margin is used. And the best component is that the exchange is ensured as long as TransferWise obtains your cash within 1 day.

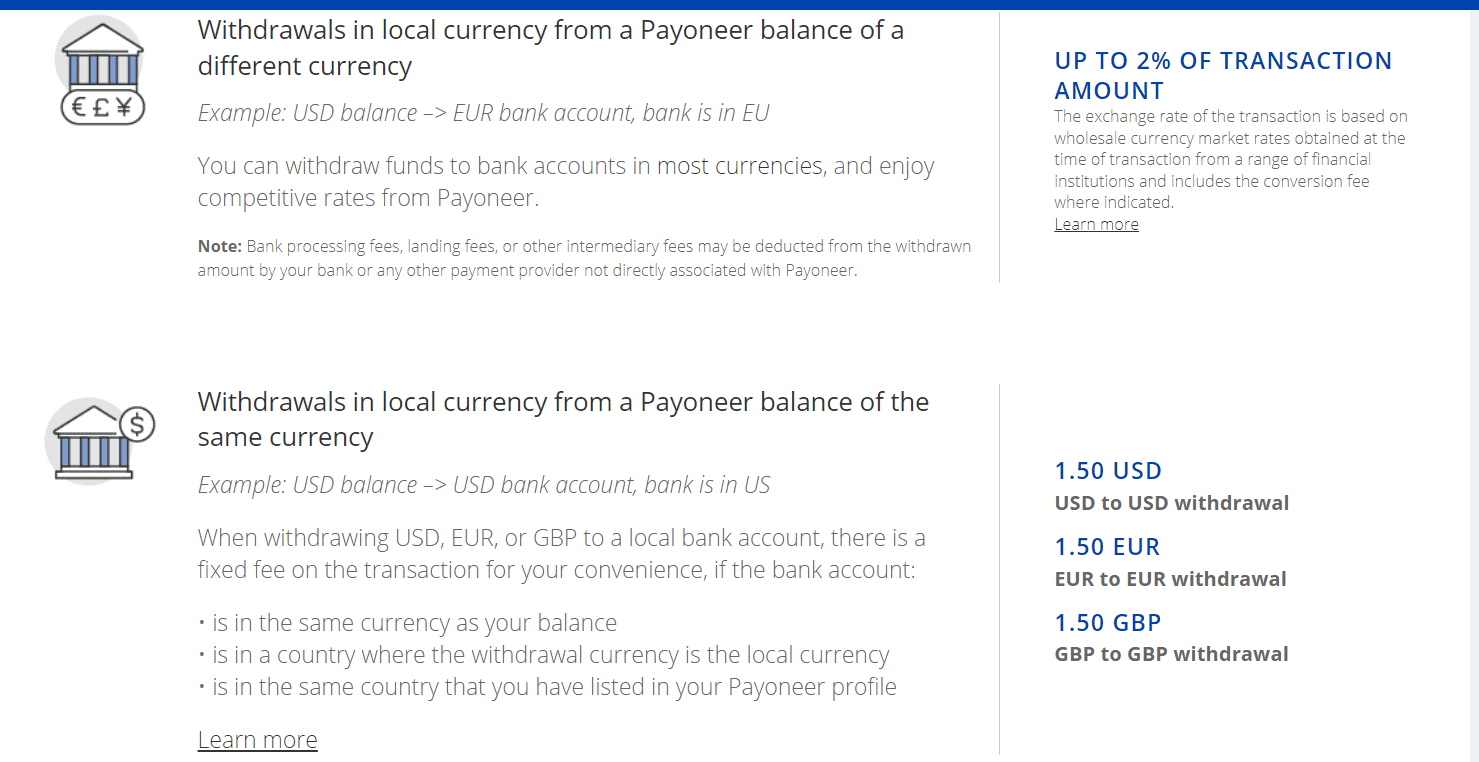

- As a consultant: You can collect settlements from foreign employers in your very own savings account in local currency. You can move the money to your national checking account or withdraw it in cash utilizing a MasterCard offered by Payoneer. You pay about 1% of the purchase as a conversion fee.

- As a company: You can pay employees as well as consultants worldwide, and you can additionally pay various other businesses or receive money on your sub-bank accounts abroad.

The enrollment procedure can take days. The distribution of your MasterCard may take more than a month depending on where you live.

As a specific, unlike TransferWise, you can not pay anybody.

As a result, it is a completely various solution. Great heading.

Transferwise (Wise) vs Payoneer Services they Offer:

Transferwise (Wise)

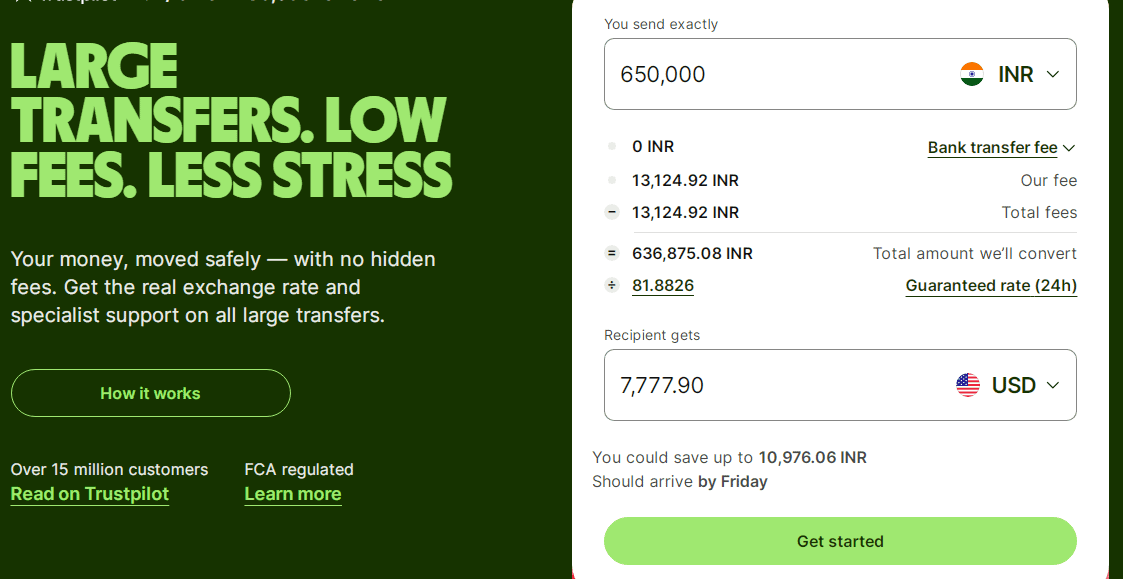

1. Large Amount Transfer:

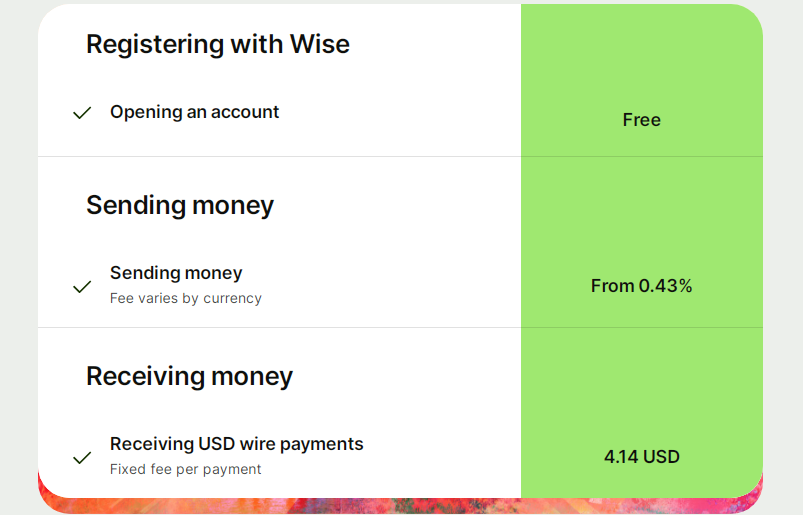

Wise makes it easier to send large transfers without having to worry about excessive fees or the stress of a complicated process.

With Wise, you can quickly set up your transfer and manage it on your own time with ease. You’ll also have access to real-time exchange rates that are more competitive than traditional banks, allowing you to get better value for your money.

And, with zero international transfer fees and free transfers between Wise members, you can make sure that more of the money you send reaches its destination.

With Wise, sending large amounts of money has never been simpler or more secure. Sign up today to start enjoying all the benefits of a fast and stress-free way to send your funds.

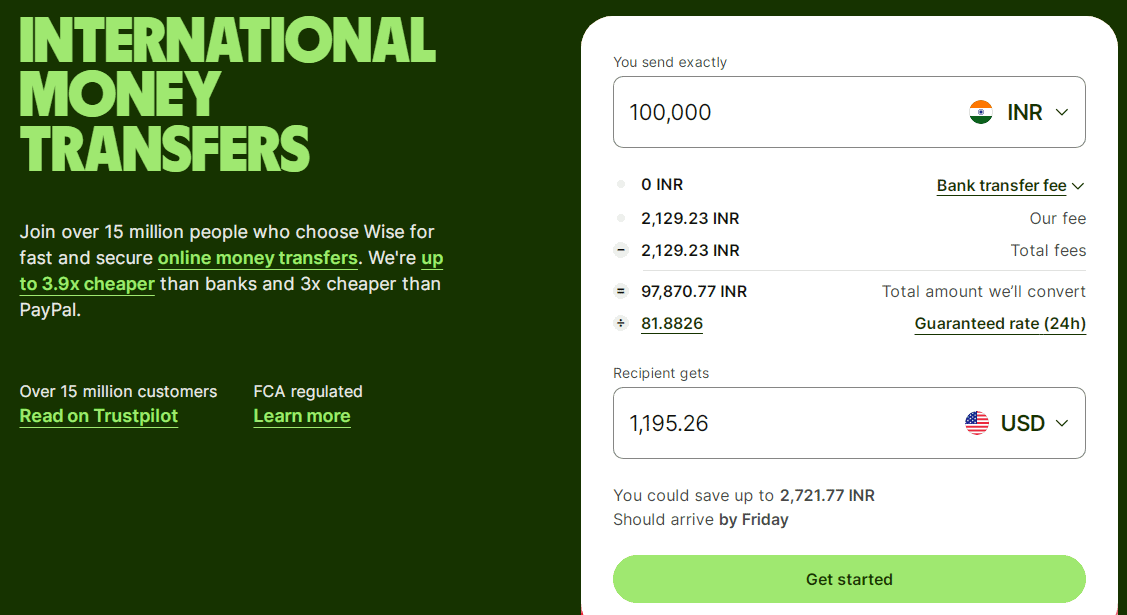

2. International Money Transfers:

Wise is the leading international money transfer service, offering fast, secure and low-cost transfers to over 15+ countries.

With Wise, you can send money abroad safely and at unbeatable rates – usually up to 4x cheaper than using a bank.

What’s more, you’ll be able to keep track of your transfers every step of the way, using Wise’s intuitive online tracking system.

Whether you need to send money home or make a payment overseas, Wise is here to help. With their simple, secure platform and excellent customer support team, transferring money abroad has never been easier.

Plus, with just a few clicks you can transfer money in minutes – no paperwork required. So why wait? Sign up to Wise today and start sending money overseas with confidence.

Payoneer:

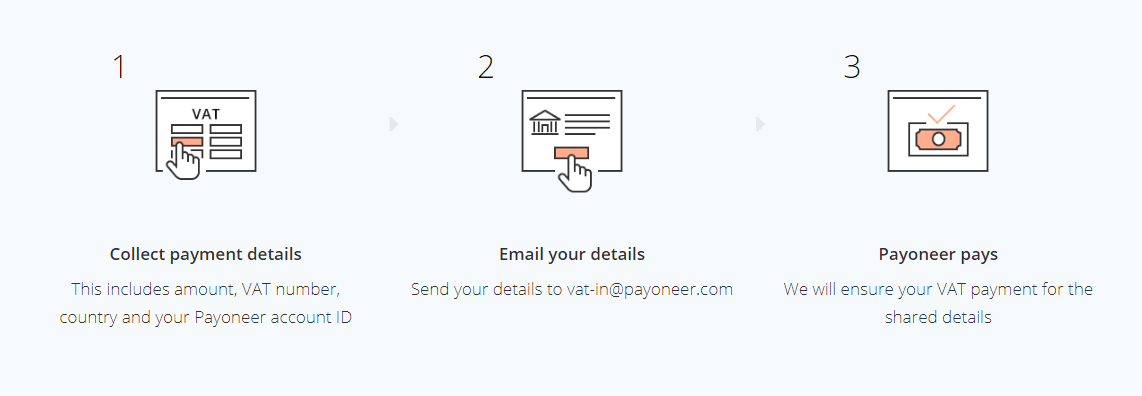

1. Pay VAT

Payoneer’s VAT Payment service makes it easy to pay your EU or UK Value Added Tax (VAT) with no hassle and no extra fees. Simply log into your Payoneer account, enter the amount due and submit your payment.

It’s that simple! With no expensive currency conversion costs or hefty transfer fees, you can save money and keep your business running smoothly.

Plus, you’ll get the peace of mind knowing that your payments are secure and reliable. Make sure to take advantage of all the benefits Payoneer has to offer, including our convenient VAT Payment service!

With Payoneer VAT Payment service, you can rest assured that your payments are secure, reliable and cost-effective.

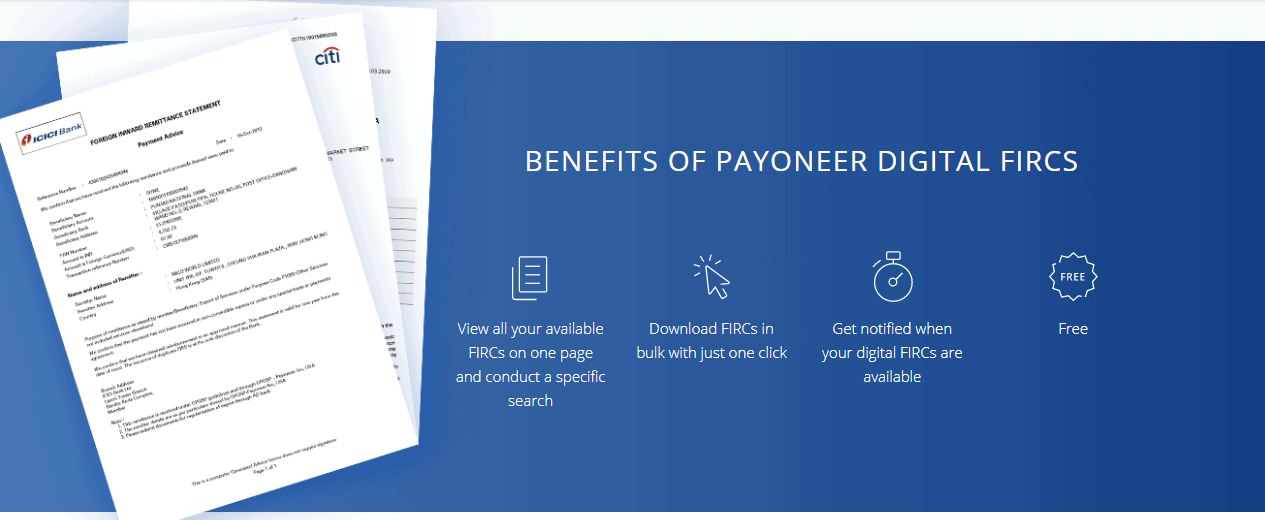

2. Digital FIRC:

Payoneer’s Digital FIRC service is perfect for businesses who are looking to streamline their payments process.

With this reliable and secure payment solution, companies can simplify the way they issue payments to suppliers and vendors.

The Digital FIRC ensures that all transactions are verified with bank-grade security, providing an extra layer of protection to keep your business safe.

Plus, with a user-friendly interface, it’s easy for anyone to set up and manage payments quickly and securely.

With Payoneer’s Digital FIRC service, you can ensure that all your suppliers and vendors are paid promptly and accurately, giving you peace of mind knowing that your payments are being handled safely and reliably.

Whether you’re running a business large or small, Payoneer’s Digital FIRC service is the perfect way to streamline your payments process.

Pros & Cons of Wise vs Payoneer

Wise:

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Payoneer

| Pros | Cons |

|

|

|

|

|

|

|

|

Quick Links:

Final Verdict: Wise Vs Payoneer 2026

To conclude, there are a number of pros and cons to both Wise and Payoneer as money transfer services. Both options offer good exchange rates, quick transfers, and secure methods for moving funds between countries.

Ultimately, choosing the service that’s right for you will depend on your individual needs. Additionally, make sure to thoroughly read the terms of use prior to making a decision so you understand what you’re signing up for.

It’s also important to compare various available options with each other in order to determine which one best meets your requirements.

Undoubtedly, each money-transfer provider has its own advantages and disadvantages – by taking all the relevant factors into account and doing some research beforehand, you can be sure to end up with the most suitable choice for your particular circumstances.