Both Revolut Vs Transferwise are well-known for their low-cost money transfers. This blog post will compare the two services to help you decide the best option for Amazon sellers.

We’ll look at factors such as transfer fees, exchange rates, and delivery times to help you make an informed decision. So, which service is best for you? Keep reading to find out!

What is Revolut?

Revolut is a cutting-edge financial technology company that has revolutionized the global banking industry. Using advanced data analytics, Revolut is able to offer highly personalized financial products and services that are tailored to the unique needs of its users.

Whether you need to send money overseas or invest your savings, Revolut gives you all the tools you need to manage your finances with speed and ease.

Additionally, Revolut is completely secure, using top-of-the-line encryption and other advanced security protocols to keep customer data safe at all times. Overall, Revolut is a game-changing platform that has truly revolutionized how people think about and use money.

https://youtu.be/QabM_PvBtsI

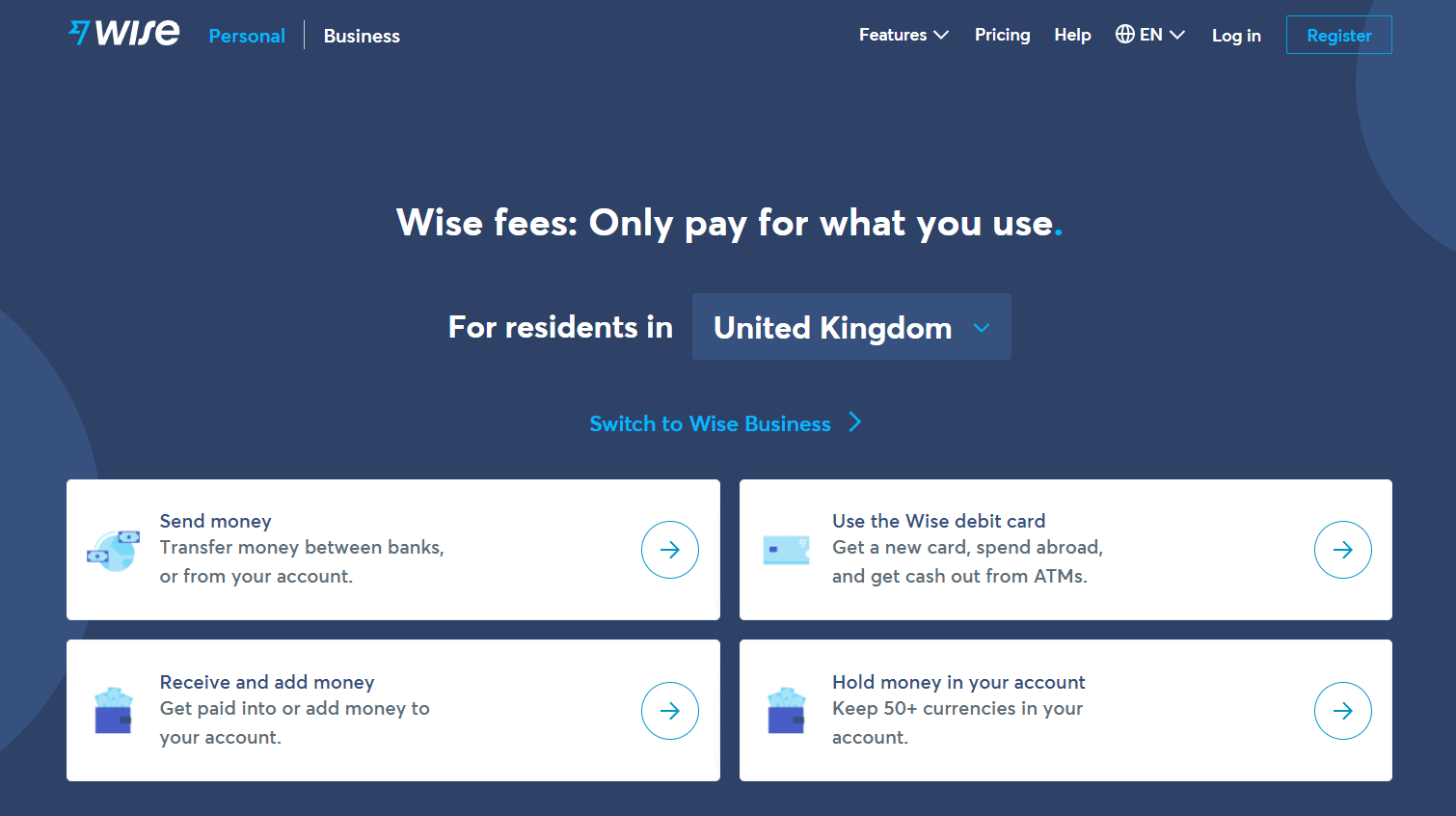

What is Wise – TransferWise?

Founded in 2011, Wise is a money transfer service that allows users to send and receive international payments at the real exchange rate. With over 10 million customers worldwide, Wise has quickly become one of the most popular ways to send money abroad. So how does it work?

When you sign up for a Wise account, you’ll be given a unique account number and sort code that you can use to receive payments from anywhere in the world.

You can also link your Wise account to your bank account, which makes it easy to keep track of your finances in one place. For sending money, you can either use your debit card or wire transfer funds from your bank account.

The funds will then be converted into the local currency at the real exchange rate and transferred to the recipient’s bank account. One of the best things about Wise is that there are no hidden fees – you’ll always know exactly how much you’re paying and how much your recipient will receive.

With its simple, transparent pricing and easy-to-use platform, Wise is a great choice for anyone looking for a hassle-free way to send money abroad. Try it today!

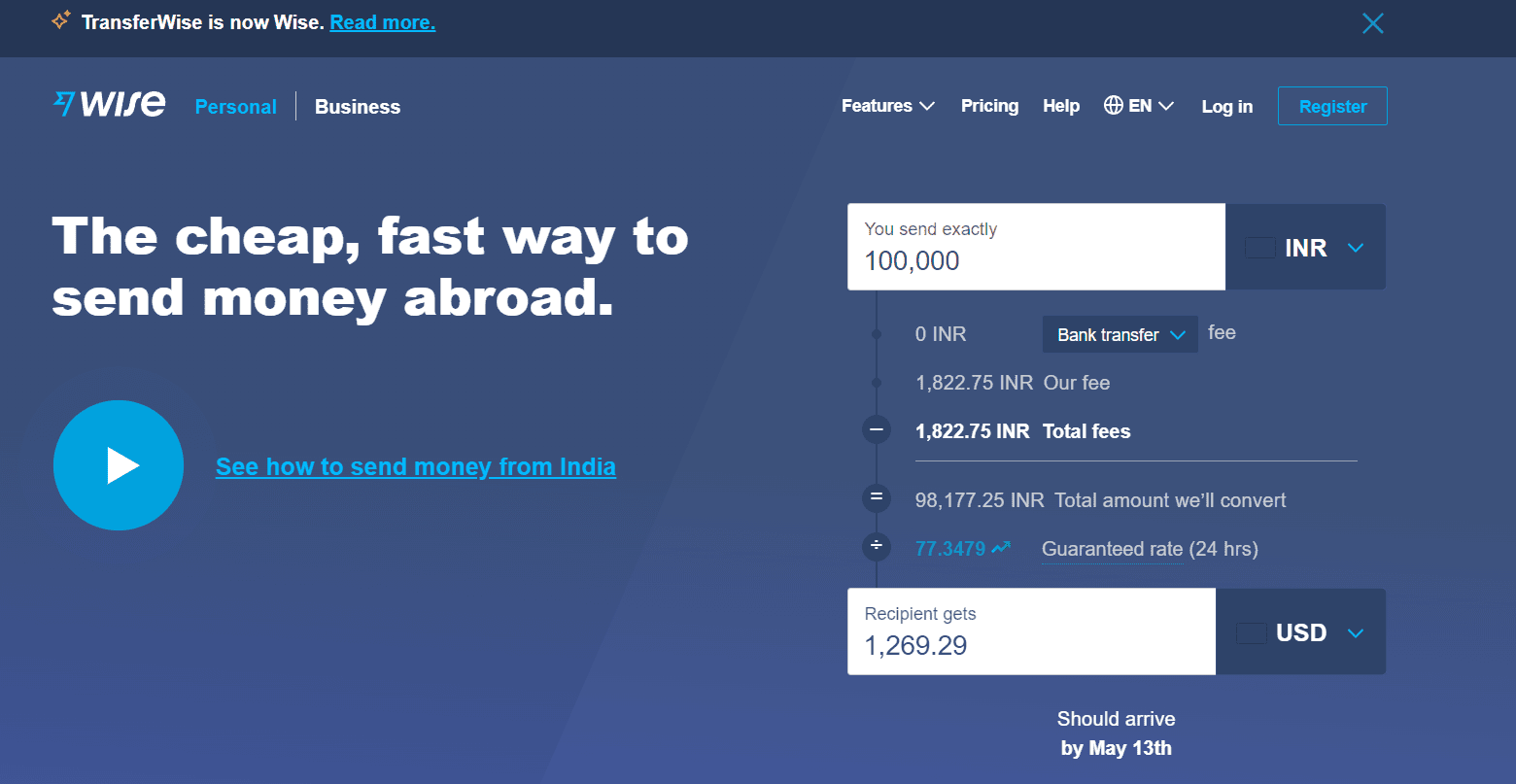

TransferWise Pricing

TransferWise is a popular money transfer service that offers affordable and transparent pricing. Unlike many of its competitors, TransferWise does not charge hidden fees or large upfront fees for transferring your funds.

Instead, you only pay a small percentage of the amount being transferred, along with a variable fee based on the currency that you are sending.

This simple and straightforward approach makes it easy to get an accurate estimate of how much your transfer will cost before you even begin the process.

Whether you’re sending money overseas to support your family or doing business across borders, TransferWise has the tools and services to make seamless and affordable money transfers a reality.

So if you’re looking for an exceptional value in money transfer services, look no further than TransferWise.

Can I use TransferWise on Amazon?

TransferWise is a popular money transfer service that allows users to send and receive money internationally. One of the benefits of using TransferWise is that it offers competitive exchange rates.

However, some users have wondered whether they can use TransferWise on Amazon. Unfortunately, the answer is no. Amazon does not currently support any third-party payment processors, and that includes TransferWise.

That means that you will not be able to use TransferWise to pay for your Amazon purchases. If you want to use TransferWise, you will need to find another way to send money to Amazon, such as through a bank transfer.

Is there a Workaround for TransferWise Users?

Since its inception, TransferWise has been a reliable and affordable way to send money abroad. However, recent changes to the service have left many users feeling frustrated.

In particular, the new “Pay by Bank” feature has caused problems for those who want to send money to countries where TransferWise is not yet available. While it is possible to use an intermediary bank to send money through TransferWise, this workaround is not always reliable.

Moreover, it can often be more expensive than using a traditional money transfer service. As a result, many users are left wondering whether there is a viable workaround for TransferWise.

At present, the best solution seems to be using an intermediary bank. However, it is important to research the fees charged by different banks before selecting one. With a little bit of effort, it should be possible to find an affordable and reliable solution for sending money abroad.

Revolut Vs Transferwise: Which Is Better?

When it comes to international money transfers, there are a few different options to choose from. However, two of the most popular choices are Revolut Vs Transferwise. So, which is the better option?

Both Revolut Vs Transferwise offers fast, convenient, and affordable international money transfers. However, there are a few key differences between the two companies.

For example, Revolut offers a wider range of financial services beyond just international money transfers. This includes things like currency exchange, spending tracking, and even access to a cryptocurrency exchange.

Transferwise, on the other hand, focuses solely on international money transfers. As a result, it can sometimes offer better exchange rates than Revolut.

Ultimately, the best choice for you will depend on your specific needs and preferences. If you’re looking for a one-stop-shop for all your financial needs, Revolut is probably the better option.

However, if you’re solely interested in getting the best possible rate on international money transfers, Transferwise is worth considering.

Conclusion- Revolut Vs Transferwise (Now Wise) For Amazon Sellers 2024

So, which of these money transfer services is better for Amazon sellers? The answer largely depends on what you are looking for. If you want the cheapest option with no frills, Transferwise is probably your best bet.

However, if you want more features and a more user-friendly experience, Revolut may be a better choice. Ultimately, it’s up to you to decide which service works best for your needs.

Have you tried using either Revolut Vs Transferwise for your Amazon business? Let us know in the comments how it went!

Quick Links